Is your company ready to accept cryptocurrency payments, but you're not sure where to start?

The first thing you need is a wallet.

A cryptocurrency wallet is a software program that stores your private key (think of it as a password) in order to talk to the blockchain. The wallet enables you to do things like monitor your balance and send or receive coins.

How do crypto wallets work?

In contrast to physical wallets, which hold tangible cash, crypto wallets technically never store your funds. Your funds live on the blockchain and are only accessible via your private keys.

That’s why the idea of sending coins is a bit misleading. Coins never actually go anywhere. When you send someone coins, you are assigning ownership to them through the use of your public and private keys, and your digital signature.

Think of a blockchain as a giant public ledger. As you make a transaction, your wallet verifies that the public and private keys match. Then, when the transaction is complete, the sender and receiver’s ledger balances change on the ledger. The ownership of the coin(s) is digitally signed over to the receiver.

Wallets play a crucial role in accepting and spending cryptocurrencies. Because a wallet is how you access your coins and private keys, keeping your wallet password and private key safe is the most important aspect of transacting with crypto.

How do I choose the right crypto wallet for my business?

Most businesses have different wallets for different purposes. Think of each wallet as an account. Businesses often have bank accounts that serve various purposes (i.e. operational expenses, payroll, and trust accounts). Similarly, a business ought to have multiple types of crypto wallets — each with its own purpose.

In order to choose the best crypto wallet(s) for your business, there are a few things to consider:

- Are you only using crypto for payments or are you also holding crypto in your corporate treasury?

- Do you prefer to have control over your private keys or prefer to use a trusted custodial service? If you prefer to retain control, how many people in the company will have access to private keys? What protocols will you deploy for signing crypto transactions? What safeguards do you have in place in case of a rogue employee or unforeseen event?

- Are you using crypto for payroll?

Most businesses will need at least two crypto wallets (often a cold wallet for long-term storage and a hot wallet for regular transactions) but it's not uncommon to use more than two.

There are many different types of wallets to choose from — from hardware wallets like Ledger to web wallets like MetaMask. Each wallet type has its own use case and respective degree of security.

What kinds of crypto wallets are available?

There are two primary kinds of non-custodial wallets (where you control your funds): hot wallets and cold wallets.

Hot Wallets

Hot wallets are almost always connected to the internet. Since an internet connection is required to make transactions, hot wallets are the most commonly used type of crypto wallet. They can live on your internet browser, your computer, or phone. Hot wallets are the most convenient crypto wallet, but the constant connection to the internet makes them more vulnerable to attack than cold wallets (which are almost never connected to the internet).

Here are the most commonly used types of hot wallets:

- Desktop wallets

- Mobile wallets

- Web wallets

Desktop Wallet

To use a desktop wallet, you simply download the wallet software and install it on your computer. While this provides quick and easy access to your coins, desktop wallets are more vulnerable to exploits and malware that make their way onto your device. Proper crypto security hygiene is imperative always, but particularly with desktop wallets.

Desktop wallet tip: Make sure you check and double-check that the URL you're downloading the wallet from is correct. Phishing attacks impersonating well-known crypto wallets are not uncommon and it's possible to accidentally download malicious software that imitates a real crypto wallet.

Best desktop wallet: Exodus Bitcoin & Crypto Wallet. Exodus also has an exchange, where you can purchase crypto directly in your wallet. Exodus also offers a mobile wallet (more on mobile wallets below).

Mobile Wallets

Mobile wallets are app-based wallets connected to your mobile phone. If you're on the go and hope to send or receive crypto, mobile wallets are safe and simple to use. You can access your mobile crypto wallet just like any other app on your smartphone. Mobile wallets are typically used by individuals rather than businesses, but a mobile wallet could be useful for a small business like a bakery or barber shop to accept crypto payments from customers peer-to-peer.

When setting up a mobile wallet, it's important to record the seed phrase on and store it in a safe place (such as a physical notebook in a fireproof safe) as this is your account recovery password. In the event your phone is lost or stolen, access to your coins is quickly reinstated by entering the seed phrase in your new device.

Mobile wallet tip: Never store your seed phrase or private key on a computer or cell phone. Don't be lazy and take a screenshot. Write your seed phrase down to keep your funds secure in the event your mobile device is compromised.

Best mobile wallet: Coinbase Wallet. Not to be confused with the Coinbase exchange, which is an exchange and custodial service. Coinbase Wallet is noncustodial, meaning you control your own private key (This also means that Coinbase customer service won't be able to help if you lose your private key.) Mycelium is another respected mobile bitcoin wallet.

Web Wallets

Web wallets are the most commonly used type of wallet in the Web3/DeFi ecosystem. They live in your browser as a plugin and are convenient to connect to DeFi protocols or DApps. If you've ever used an NFT marketplace or interacted with a decentralized exchange like UniSwap, then you've probably used a web wallet like MetaMask.

Web wallets are convenient for frequent access to your funds, but they are less secure than a hardware wallet since they're connected to the internet. Furthermore, if the third-party wallet ever suffers a breach of any kind, or if they go out of business, your coins could be stolen or lost forever. It's not recommended to keep your HODL stash in MetaMask or any web wallet.

Best web wallet: MetaMask. MetaMask is the gateway between your browser and popular smart-contract based protocols like Maker, AAVE, or NFT marketplaces like OpenSea. To get started, download the MetaMask app to your browser and transfer funds from a trusted exchange to your MetaMask address. As of May 2021, the Coinbase Wallet can be used as a web wallet in your browser, similar to MetaMask.

Multisig Wallets (best for companies)

Multisignature (or multisig) wallets make the most sense for teams, businesses, or DAOs since they create multiple checks and balances to transfer funds. Multisig wallets require a designated number of people to sign off on a transaction before funds can be moved. This helps avoid bad actors from stealing funds and prevents unauthorized access to your company’s crypto.

Best Multisig Wallet: Gnosis Safe. We recommend Gnosis for companies to safely transact with crypto. You can customize how many signatures are needed to confirm a transaction and there are options to use Gnosis on web, desktop, and mobile.

Cold Storage Wallets

Cold wallets are almost never connected to the internet, which makes them very difficult to hack. While cold wallets are the most secure, they are also the hardest to access since they lack a constant connection to the internet. They are best used for longterm storage of funds. There are a few different options for cold storage wallets, such as paper wallets and USB drives, but for businesses, we recommend hardware wallets.

Hardware Wallets

Hardware wallets are one of the safest and most secure methods of cold storage. These wallets are offline when not connected to your computer and look like a thumb drive. Crypto hardware wallets can be connected to the internet via the USB port on a computer to transmit funds. The sending of the cryptocurrency is done in-device, making it impossible to hack remotely.

Harware wallet tip: When purchasing a hardware wallet, always buy it directly from the manufacturer. Third-parties have been known to tamper with devices in order to steal funds. And remember that cold storage options also require crypto security precuations. Again, never store a seed phrase on your cell phone or computer. Writing them down is the best practice.

Best Hardware Wallet: Ledger. Ledger is one of the most popular and respected hardware wallets. They have two models: Ledger Nano S ($59) and Ledger Nano X ($119). Both are good options for longterm crypto storage. The biggest difference is the updated interface and Bluetooth capabilities on the Nano X, plus more supported currencies and apps. For most businesses, Nano S should work perfectly.

Not only does Ledger store your private keys but allows you to connect your cryptocurrencies to the greater Web3 ecosystem. By using Ledger Live, you can connect your Ledger to a large number of DeFi protocols while it’s plugged into your computer. Because of these capabilities, Ledger might more accurately be described as a hybrid wallet.

Crypto Custodial Solutions

While non-custodial wallets grant full ownership over your private keys, custodial wallets give the control of your private keys to a third party, such as an exchange.

"Not your keys, not your crypto" is a sentiment often repeated in crypto circles. While this is not untrue, many businesses prefer to use the service of a reputable custodian rather than be tasked with the safeguarding of private keys. If your technical knowledge of crypto isn't sound, your private keys might indeed be in better hands with a custodian. If you lose a password to a custodial service, you can usually recover your account with their customer service. If you lose your own private keys, that crypto is almost certainly gone for good.

Custodial wallets control your private keys through your desktop or mobile device. Typically, custodial wallets are operated by an exchange like Coinbase, which gives provides a certain level of assurance on your crypto in the unlikely event of an exchange hack. When choosing a custodial wallet, it's important to choose wisely because the custodian is the guardian of your coins.

The choice to use a custodial service comes down to your confidence in your company's crypto security hygiene, your faith in a given custodian's security, and your views on decentralization (custodians are centralized entities and must yield to the regulations of the localities they serve.) We actually recommend that most crypto newbies opt for a reputable well-known custodian for their crypto payment workflow rather than hold their own private keys—at least to start.

Best Crypto Custodians: Coinbase for a transacting with crypto, and BitGo as a longterm institutional custodian. There are a few key differences.

Coinbase

Coinbase stores and insures your cryptocurrency since it’s a custodial exchange. It’s one of the most trusted and well-known exchanges in the world. Coinbase is insured and a publicly traded company. As an exchange, Coinbase offers a seamless crypto on/off ramp and access to liquidity. They also offer multiple products specifically for businesses, such as Coinbase Custody and Institutional, but note that you have to apply and that the wait can be indefinite. We recommend not waiting on a business speficic account to use Coinbase for business purposes.

BitGo

On the other hand, BitGo is the best solution for institutional investors who want to have their crypto assets insured and stored with multi-signature security. They currently serve over 400 institutions and over 150 exchanges. BitGo is best for larger companies and institutions looking to store their crypto assets longterm.

How can I keep track of my crypto wallets and transactions?

Whether you have one wallet or twenty wallets, it's important to keep track of every transaction for accounting and financial reporting purposes.

When it comes to crypto accounting, spreadsheets are the status quo, but they're manual labor-intensive and introduce the possibility of human error.

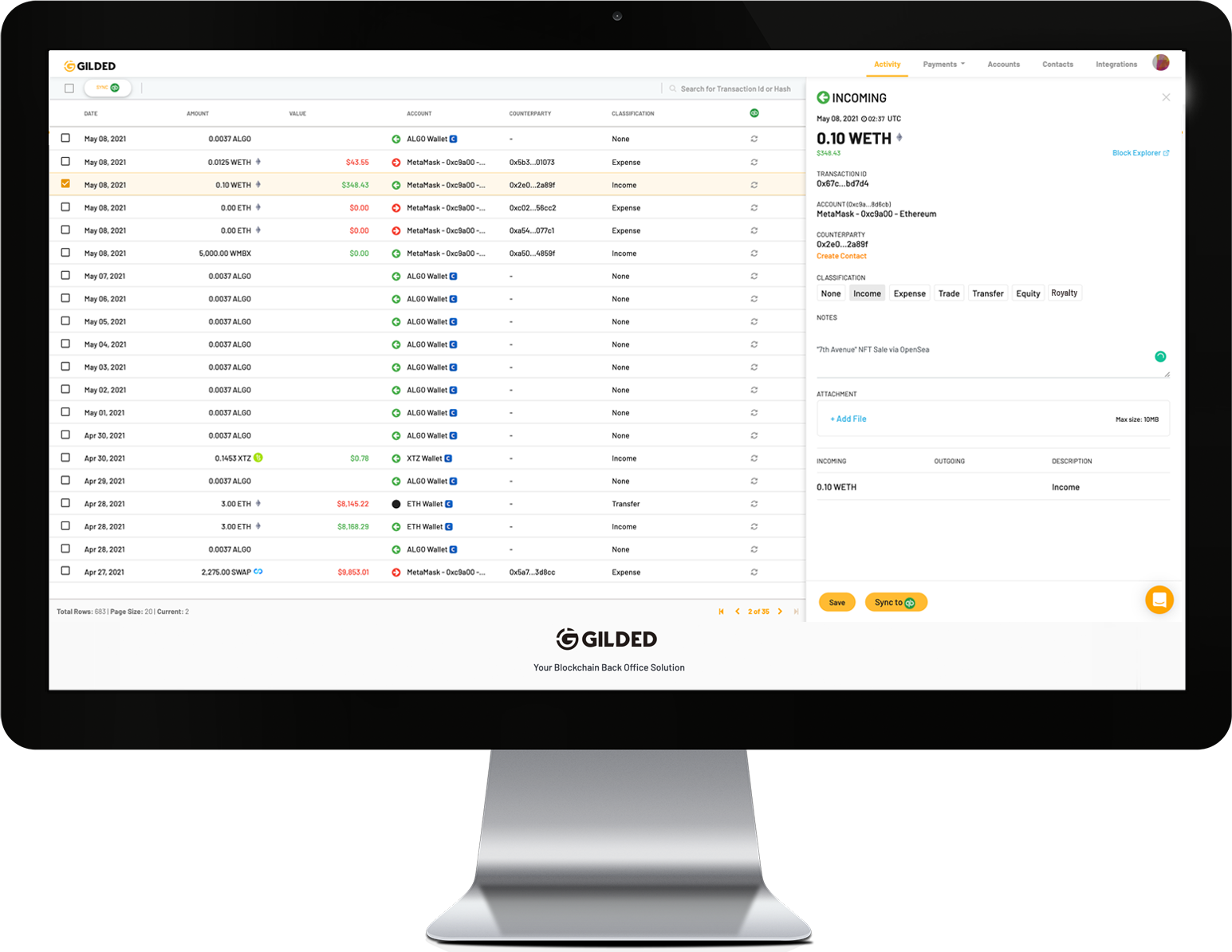

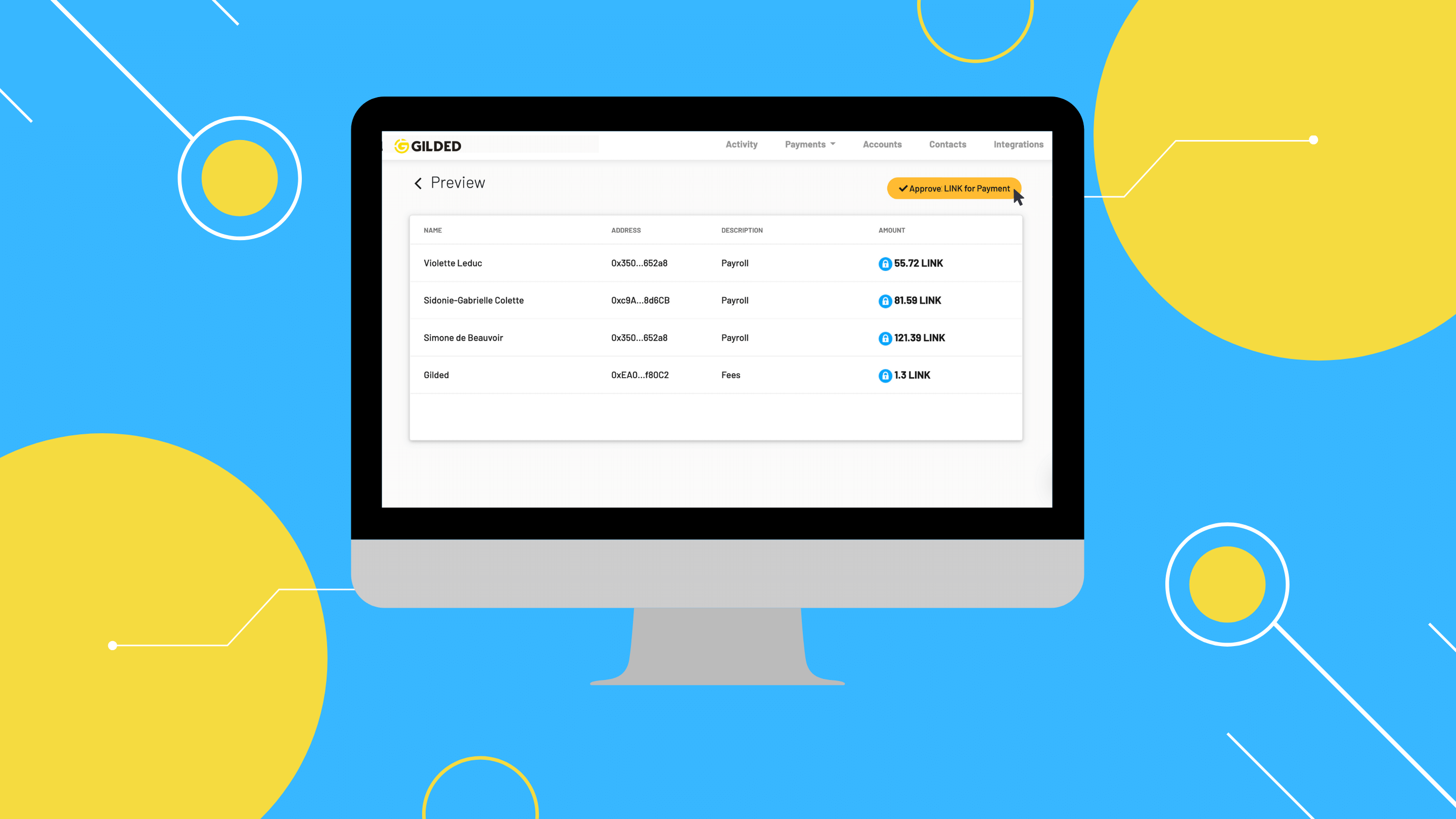

That’s where Gilded comes in. Gilded allows you to view all your crypto wallets and transactions in one sleek dashboard, add context and meaning to those transactions, and sync them to QuickBooks.

Further reading

Founded in 2018, Gilded is backed by Techstars and the Association of International Certified Public Accountants (AICPA). Gilded helps global companies scale by automating cryptocurrency payments and accounting. In 2020, Gilded announced partnerships with TrustToken, Paxos and Stablecorp to offer the world’s first B2B payment solution powered by stablecoins.