When it comes to crypto for business, bitcoin is still king. But a flippening is happening — and it's not what you might think.

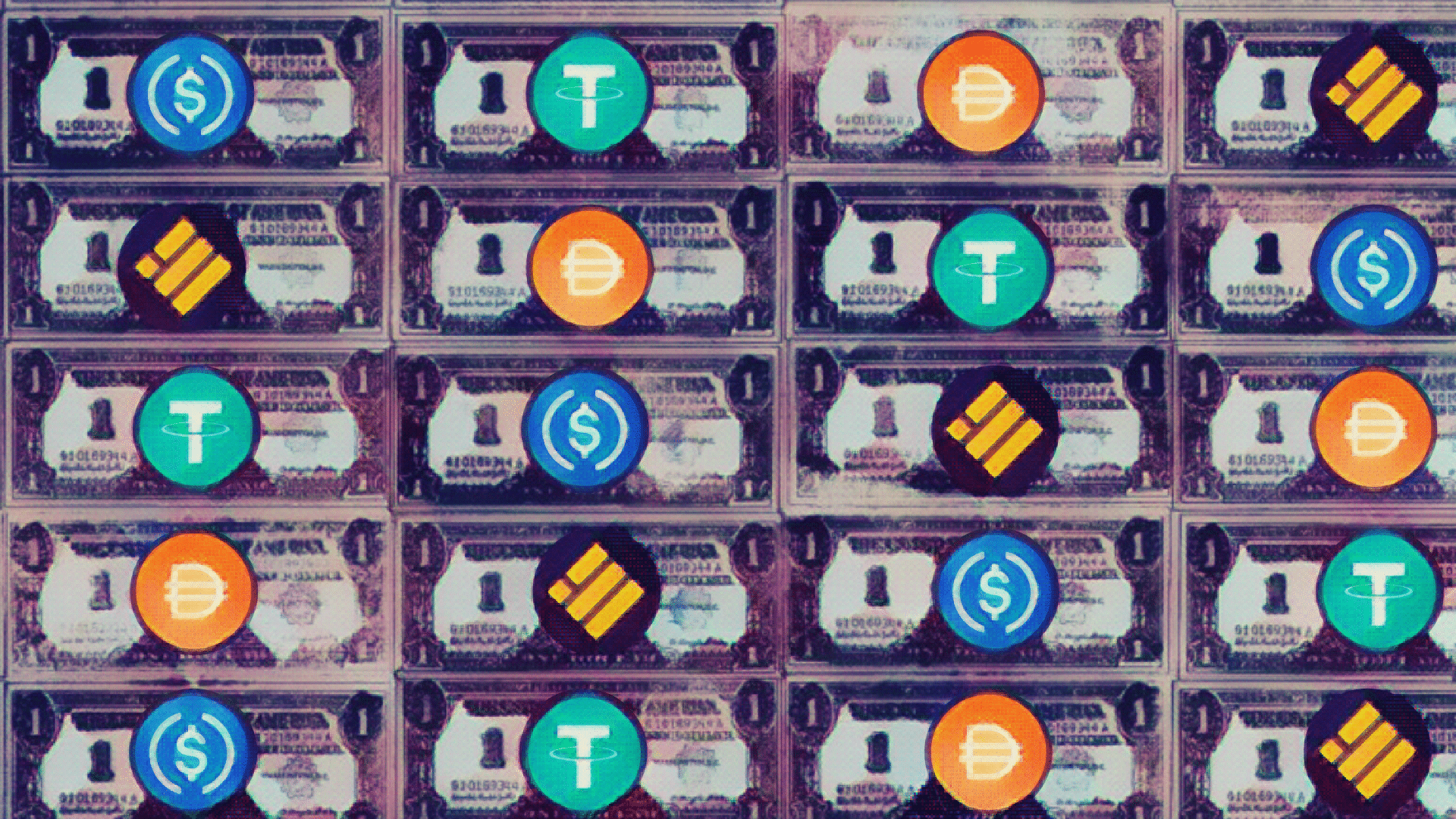

USDC, Tether, DAI.

The rise of the dollar-backed stablecoin is a game-changer for businesses, delivering real-time transaction settlement, superior security, and transparency on the blockchain — all without exposure to market volatility.

In recent months, stablecoins have exploded to a $110 billion market cap — up nearly 4x from the start of 2021. And this future trillion-dollar market is just getting started.

Companies of all kinds and DAOs (decentralized autonomous organizations) are turning to stablecoins for business transactions, crypto payroll, and corporate treasuries.

What are stablecoins?

Stablecoins are digital currencies pegged to a stable reserve asset like the US dollar or the euro (although there are different types of stablecoins which we'll cover in detail below). In contrast to volatile assets like bitcoin or ether, there is no major price fluctuation with stablecoins. Most stablecoins are ERC-20 tokens and run on the ethereum blockchain, making them compatible with any ethereum wallet.

The advent of stablecoins has bridged the gap between the legacy financial world and crypto space. For companies new to cryptocurrency, stablecoins are often the most logical choice because of their price stability and wide range of use cases.

Why should businesses use stablecoins?

Stablecoins are extremely useful assets for the flow of commerce, allowing organizations to harness the speed and power of cryptocurrency without subjecting themselves to market price fluctuations and complicated tax implications.

Real-time cross-border payments

In 1872, Western Union launched the very first wire transfer on its telegraph network. If you've ever sent an international wire transfer, you know the process hasn't improved much since.

Wire transfers require banks and intermediaries to facilitate, take days to settle, and there's no way to track the flow of funds in-between. Additionally, intermediaries rake in huge profits (billions annually) on margin fees — all for an archaic service that simply was not designed for a digital, connected world.

International stablecoin payments are sent peer-to-peer, settled virtually instantly, eliminate middlemen, and afford the sender and recipient complete transparency on the blockchain.

Diminished volatility

Critics claim that crypto is too volatile to be used as an actual currency. While this may be true for crypto assets like bitcoin and ether, stablecoins directly challenge that notion since they are, by definition, pegged to a reserve asset and designed to remain stable.

Earn high interest

You can earn interest on your stablecoins at a much higher rate (up to ~10% APY) than traditional savings accounts through various platforms. Companies, institutions, and DAOs are realizing they can use stablecoins, rather than fiat, to earn higher interest on their corporate treasuries – without exposing themselves to market conditions.

Read more: How to earn interest on your stablecoins

Simplify crypto taxes

The IRS requires individuals and businesses to report cryptocurrency transactions. If you're dealing in crypto and the asset appreciates somewhere in the flow of funds, you might end up with an unexpected tax bill at end of the year.

Transacting with stablecoins minimizes your tax burden and complicated calculations, since there are no major price fluctuations.

What are the cons of using stablecoins?

While the benefits of stablecoins are hard to ignore, we’d be remiss not to mention the potential pitfalls and some considerations to make.

Centralization

Critics of stablecoins say that they are typically run by centralized issuers and users are subject to the whims of these companies. If you prefer something more decentralized, there are stablecoins such as DAI or UST that are operated in a more decentralized and automated manner.

Dependence on traditional markets

Since stablecoins are mostly pegged to fiat currencies, their value depends on the current state of the global economy. For example, if the USD is impacted by inflation, then stablecoins like USDC and USDT are also affected.

Potential regulation

Stablecoins are subject to regulation just like bitcoin and other cryptocurrencies. In fact, stablecoins have taken center stage in many regulators' agendas as they decide how to tax and regulate the industry. We welcome *healthy* regulation with open arms but not at the peril of innovation.

New market risk

With emerging technologies and forms of currency like stablecoins, it is imperative to do your own research on the safety and efficacy of each particular coin. There have been some technological failures for certain stablecoin projects in the past, so it’s best to stick with the stablecoins we recommend below.

What are the different types of stablecoins?

Here's a look at the three most common types of stablecoins: fiat-pegged, crypto-collateralized, and algorithmic stablecoins.

Fiat-collateralized Stablecoins

The most common type of stablecoins are fiat-collateralized — pegged 1:1 to fiat currency, such as the U.S. dollar (USD). The fiat collateral is typically held by a centralized institution, and it must remain proportional to the number of stablecoins issued to users. For example, if the issuers hold $1 million in USD, they must issue 1 million stablecoins, each worth $1.

Popular fiat-collateralized stablecoins: Tether, USDC, Gemini Dollar, Paxos Standard, and True USD

Crypto-collateralized Stablecoins

Crypto-collateralized stablecoins are backed by various cryptocurrencies as collateral and considered more decentralized to many crypto-native users. They are a critical component of the DeFi ecosystem. Rather than relying on a central issuer, the process of crypto-collateralization occurs on-chain through a smart contract.

In order to receive a crypto-backed stablecoin, you must over-collateralize another crypto asset (such as ethereum), which enables a stable market price for the stablecoin. Typically, in order to retrieve your collateral, you pay the stablecoins back into the smart contract and liquidate your position.

Popular Crypto-Collateralized Stablecoin: Dai (DAI), TerraUSD (UST)

Algorithmic Stablecoins

Algorithmic stablecoins are a newer type of stablecoin not backed by fiat, cryptocurrency, or any other type of collateral. Instead, the value is held stable by algorithms wrapped up in smart contracts that automatically manage the total supply of the stablecoin.

If the price falls below a certain threshold, the algorithm will reduce the number of coins in supply. But if the price rises above the desired threshold, more tokens are issued to send the price back down. It’s an algorithmic battle between supply and demand.

Learn more about the intricacies of algorithmic stablecoin design here.

Popular Algorithmic Stablecoins: Fei (FEI) and Celo Dollar (cUSD)

What are the best USD stablecoins for businesses?

USD stablecoins make up a vast majority (>90%) of the overall stablecoin market. Below are some of the most popular USD stablecoins.

1. USD Coin (USDC)

The USDC stablecoin is backed 1:1 to the USD and fully backed by fiat in a reserve. It’s issued by a consortium between Circle and Coinbase called Centre. USDC is the second-largest stablecoin, behind Tether. USDC is the fastest-growing stablecoin showing no signs of slowing down.

Token-type: ERC-20 (ethereum blockchain)

Where to buy USDC: The best place to convert USD to USDC is Coinbase.

2. Tether (USDT)

Like USDC, Tether is also pegged to the USD. Although Tether has run into controversy surrounding the monitoring of reserve assets, Tether remains the largest stablecoin, capturing 60% of the market and is used by crypto traders and companies around the world. As always, do your own research.

Token-type: ERC-20 (ethereum blockchain)

Where to buy USDT: Tether can be purchased and exchanged on most major crypto exchanges.

3. Dai (DAI)

DAI is a stablecoin issued by MakerDAO which operates through smart contracts called Maker collateral vaults to collateralize various assets and issue DAI. To retrieve your original collateral, you pay the DAI back into the smart contract. DAI is currently the 4th largest stablecoin and widely used in the DeFi ecosystem.

Token-type: ERC-20 (ethereum blockchain)

Where to buy DAI: You can purchase DAI on most crypto exchanges or generate DAI using a Maker vault.

4. Binance USD (BUSD)

Users are able to purchase BUSD on the Binance exchange. In order for BUSD to stay pegged 1:1 to the dollar, Binance partnered with Paxos to provide the USD collateral reserves. BUSD can be used interoperably on the ethereum blockchain and Binance chain.

Token-type: Interchain, ERC-20 (ethereum blockchain) and BEP-2 (Binance chain)

Where to buy BUSD: Binance USD can be purchased on the Binance exchange.

5. TrueUSD (TUSD)

TUSD is pegged 1:1 to the USD, and it’s built on the TrustToken platform. The TUSD stablecoin is fully collateralized by USD and held by a third-party escrow.

Token-type: ERC-20 (ethereum blockchain)

Where to buy TUSD: TrueUSD can be purchased on several major exchanges, including Binance, Bittrex, Huobi, and decentralized exchanges like Uniswap and PancakeSwap

6. TerraUSD (UST)

Launched as a collaboration between Terra and Bittrex Global, UST aims to be interoperable between every blockchain, starting with Ethereum and Solana. It’s pegged 1:1 to the USD and is considered the first decentralized stablecoin that is scalable, yield-generating, and inter-chain.

Token-type: Interchain

Where to buy UST: TerraUSD can be purchased on Coinbase Pro, Kucoin, Bittrex, and various decentralized exchanges.

7. Reserve (RSV)

Reserve is a flexible pool of stablecoins currently backed by the USD. It was created to be a stable, decentralized stablecoin for countries impacted by high inflation. Today, it’s primarily used by individuals and business owners in Venezuela, but Reserve has plans to expand to other countries with high-inflation.

Token-type: ERC-20 (ethereum blockchain)

Where to buy RSV: Reserve can be purchased on Gate.io, Bittrex, and various decentralized exchanges like UniSwap and Kyber Network.

What about non-USD stablecoins?

Since most stablecoins are pegged to the US dollar, this can complicate crypto transactions for businesses outside of the United States.

The list of non-USD stablecoins is short but constantly evolving. It’s important to note that the trading volume for non-USD stablecoins is quite low. Use with caution or stick to USD-pegged stablecoins if possible.

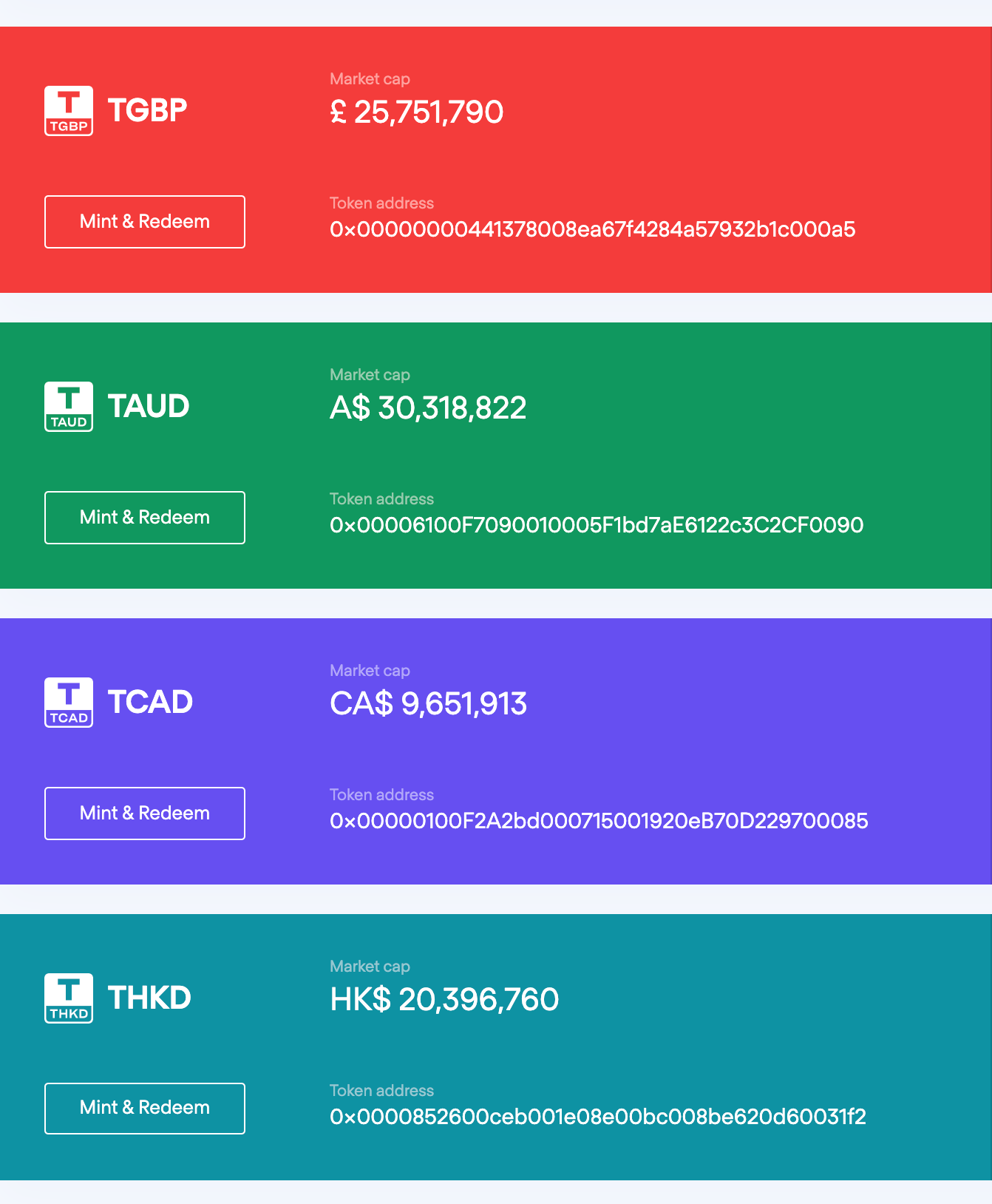

TrustToken Non-U.S. Stablecoins (TGBP, TAUD, TCAD, THKD)

TrustToken has issued stablecoins for various national currencies (TrueCurrencies) ranging from the British pound, Australian dollar, Canadian dollar, to the Hong Kong dollar. TrustToken's is establishing itself as the leader in multi-currency stablecoins.

Token-type: ERC-20 (ethereum blockchain)

Where to buy TGBP, TAUD, TCAD, THKD: TrustToken's TrueCurrencies can be purchased on Crypto.com and on Uniswap.

QCAD - Candian Dollar Stablecoin

Issued by Stablecorp, QCAD is the first mass-market Canadian dollar stablecoin. QCAD is pegged 1:1 to the Canadian dollar.

Token-type: ERC-20 (ethereum blockchain)

Where to buy QCAD: You can purchase QCAD on Newton.

CADC - Canadian Dollar Stablecoin

Issued by PayTrie, CADC is redeemable on a 1:1 basis for Canadian dollars.

Token-type: ERC-20 (ethereum blockchain)

Where to buy CADC: You can buy and sell CADC directly on PayTrie.

STASIS EURO (EURS) - Euro Stablecoin

Created by Stasis, the EURS stablecoin is pegged to the Euro and backed 1:1 with Euro reserves. With a focus on transparency, EURS receives regular attestations by one of the world’s largest accounting firms.

Token-type: ERC-20 (ethereum blockchain)

Where to buy EURS: No centralized exchanges currently offer STASIS EURO for purchase using cash. You can buy EURS with ETH via DEX aggregator 1inch.

What else should I know about using stablecoins for my business or DAO?

Whether you’re paying your team or holding stablecoins on your balance sheet to earn yield, it’s crucial to safeguard your crypto assets and properly account for them. If you want to run your business on blockchain, you'll need a full back office solution to properly support your crypto workflow.

That’s where Gilded comes in. With Gilded, you can pay your team in stablecoins, accept payments from customers, send invoices, and then reconcile every transaction in our accounting dashboard, which then syncs to QuickBooks Online.

Hundreds of companies are using Gilded today to unbank their businesses.

Ready to pay and get paid in stablecoins? See how Gilded can help.

Further reading