The decentralized finance (DeFi) movement is accelerating rapidly. As of August 2019, half a billion dollars are locked up in DeFi protocols.

New products like BlockFi, Celsius, and Compound offer interest rates to private lenders at rates unheard of in the world of traditional finance. BlockFi, for example, promises up to 4.9%* annually for deposits of Bitcoin, 3.6%* for Ethereum, and up to 8.6%* for Coinbase's USD Coin (USDC) and the Gemini stablecoin (GUSD). Compound is currently offering DAI interest rates of greater than 7%*.

The beauty of decentralized finance is that anyone in the world can participate regardless of location or socioeconomic status. Funds can be deposited and withdrawn 24 hours per day, 7 days per week with no lockup periods.

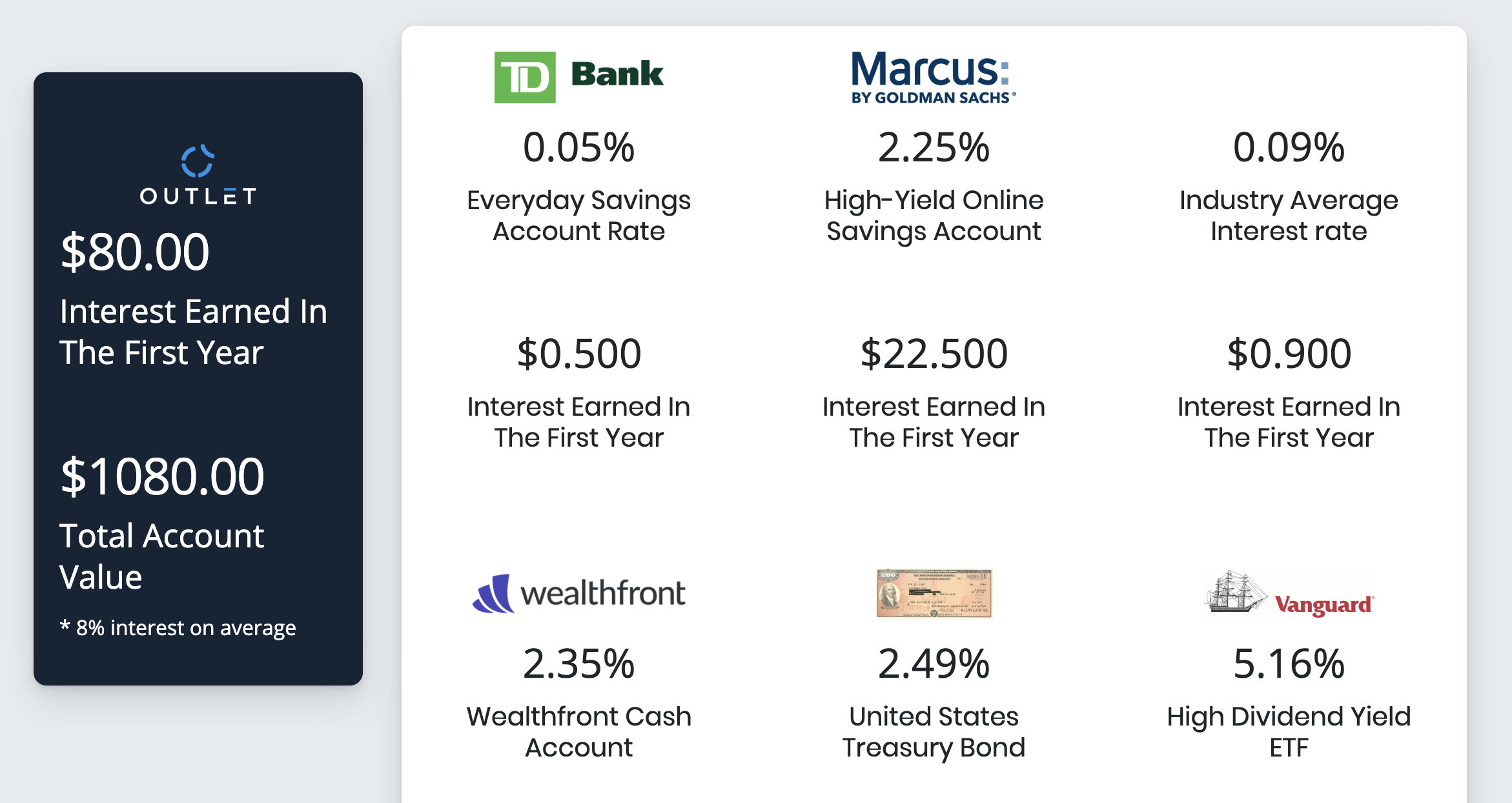

Newly launched Outlet even goes as far as comparing DeFi interest rates to those of traditional investments such as TD Bank, Wealthfront, and US Treasury Reserves.

The race is on among these competing DeFi lending products to provide a superior user experience that is irresistible to retail investors. This could very well pave the way to additional retail investment in Bitcoin and other cryptocurrencies.

Despite the attractive interest rates, loaning funds on DeFi products is not without risk. They also present fascinating accounting challenges with no clear guidance on how to recognize these new synthetic assets.

Is DeFi lending appropriate for businesses? Look for an upcoming post where we weigh the pros and cons of lending corporate treasury funds using DeFi protocols.