By Joseph "Joey" Ryan, CPA - CFO at Gilded

When I landed my first big firm job as a CPA, I was ready to live the dream. But ten years into public accounting for some of the biggest players in the profession, I found myself at a crossroads. I wasn't unhappy, but something was happening that I couldn't ignore.

That was 2017 and it was peak cryptomania. The markets were going crazy and everyone was talking about bitcoin. It wasn't the trading and investment that necessarily piqued my interest, but rather the underlying technology. I saw how blockchain could revolutionize my field and had to get involved somehow. In 2018, I left public accounting and dove into blockchain full-time.

AI, bots, and the rise of automation

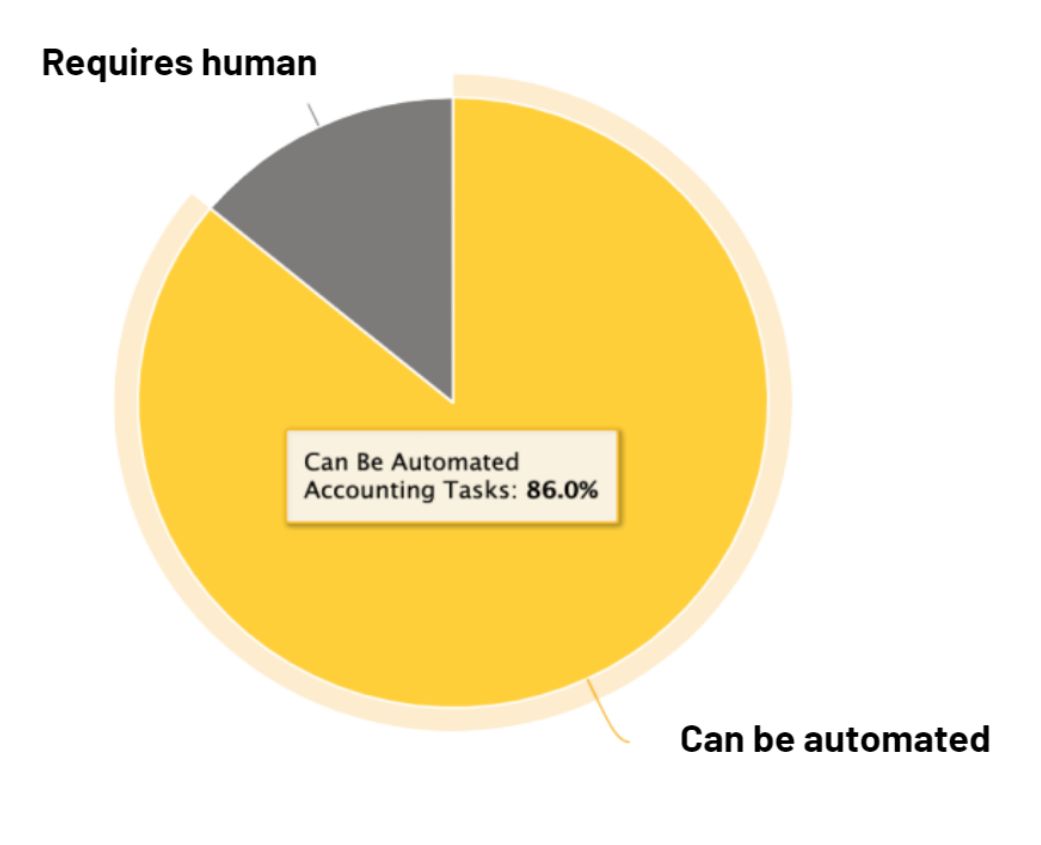

Before we get into blockchain, we should talk about automation. Recently, a statistic surfaced that 86% of all accounting tasks are capable of being automated. This has sparked a trend in accounting technology toward AI, bots, and other forms of automation. The technology is good and we are now capable of digitizing invoices, receipts, and automating reconciliation.

Data acquisition and processing are addressed on an organizational level, but it’s still limiting. Automation is siloed. What about portability and data integrity? The bots are one-sided and only as good as the documents they parse.

- What if there was a way to have accurately recorded transactions within a system without the transactions being subject to change?

- What if this process can be fully integrated with your payment and cash management systems?

- What if this process can be audited in real-time, with each transaction verified by a CPA?

Good news! This isn't an idea that's light years away. This is possible today with triple-entry accounting.

What I talk about when I talk about Triple-Entry Accounting

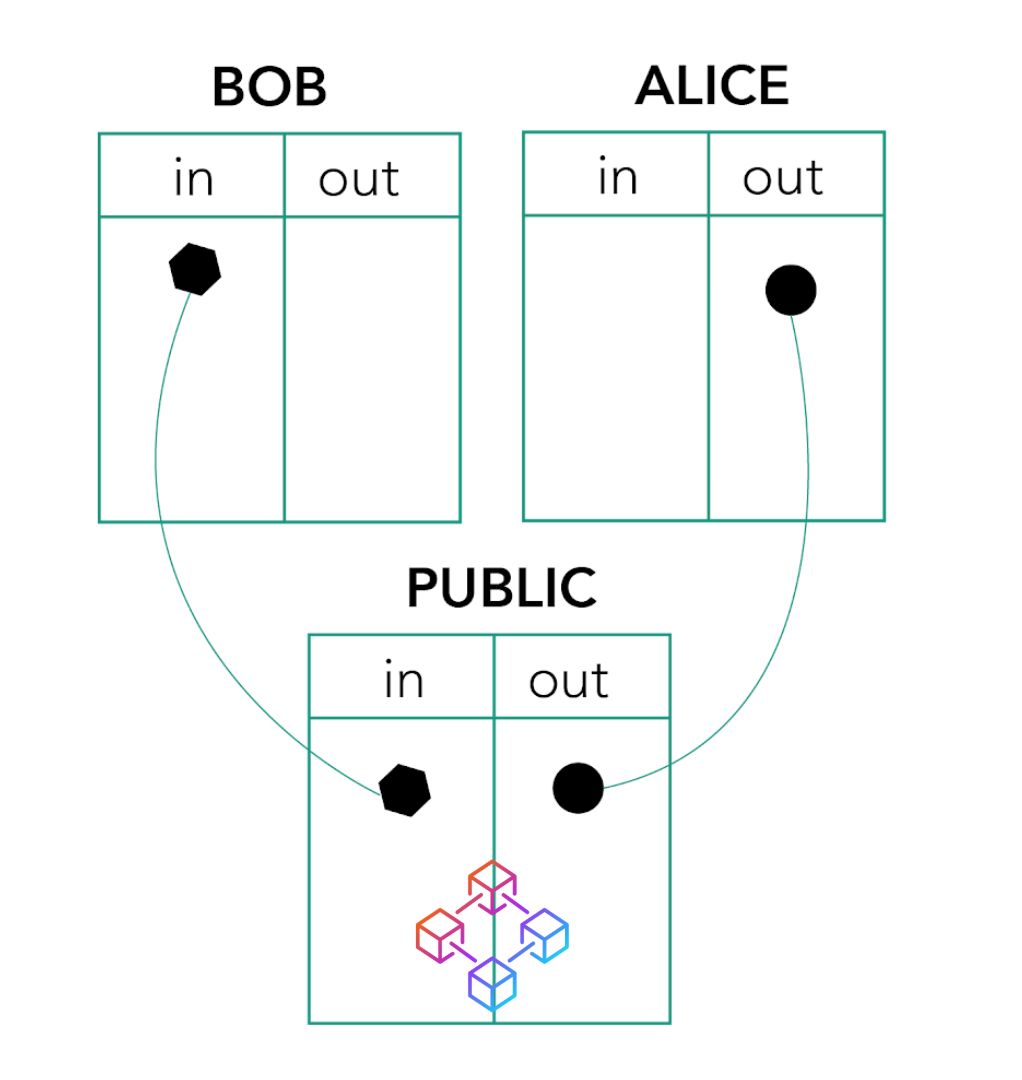

With blockchain, we're entering a new era where businesses can connect their double entry accounting systems with a third entry that links invoices directly to payments on a tamper-proof ledger. This is called triple-entry accounting.

Let me explain how it works. A transaction occurs and the surrounding payment details are recorded on the blockchain on a tamper proof immutable ledger. The blockchain then serves as the underlying data system that links to party one and party two’s financial records. With triple-entry accounting, we can seamlessly follow the world's money.

Consider the possibilities if all transactions are recorded on a blockchain:

- Verification of 100% transaction activity

- Real time access to data

- Reduced opportunities for fraud

- Connected financial data

This is not the end of the accounting profession—this is an opportunity.

Gone are the days of manual reconciliation. When a vendor sends you a bill, it will automatically appear in your accounting system. When you pay that bill, the payment will be recorded in your accounting system and the vendor’s.

An auditor can then run a computer program to verify that a transaction occurred between two known parties for a specific reason. Essentially, this makes it possible to audit in real-time.

The day we have this running at scale is the day that we substantially reduce financial risk. Now, this is not the end of the accounting profession—this is an opportunity. An opportunity allowing accountants to automate mundane tasks so we can focus our time and efforts on providing valuable financial insight and analysis.

This is the dawn of a brand new era of accounting.

New Beginnings

In 2018, I met Gil Hildebrand and along with Ken Gaulter, Raina Casbon-Kelts, and Eledi Dyrkaj, we founded Gilded. The mission of Gilded is to harness the power of blockchain to simplify and improve payments and accounting for global companies. Recently, we completed the Techstars Blockchain Accelerator program in New York City. Today, Gilded has a proof of concept triple-entry accounting system running on the Ethereum blockchain. We packaged it up into digital asset accounting and payments software and launched it this past November.

With Gilded, businesses can perform digital asset invoicing, digital asset bookkeeping, digital asset tax reporting, and integrate digital asset transactions into QuickBooks.

Invoices created using Gilded or any other product that supports the triple-entry protocol will automatically be ported and synced to the accounting systems of any counter-parties on the triple-entry network.

The triple-entry protocol we're using is a shared protocol that can be implemented in any accounting software to create an interoperable network of vendors sharing portable and auditable financial records.

Undeniably, this is the future of accounting and it's here and ready to be tapped into today.

Request a demo to learn more about Gilded's accounting software.