By Mohammad Musharraf

Cryptocurrency is more popular than ever. In 2019 in the United States alone, 36.5 million people own some form digital currency, but only a fraction are tapping into the major advantages it offers over fiat currency.

Many remain skeptical because of the volatile nature of crypto. There are horror stories circulating about traders losing millions in a matter of seconds, which not only deters people from embracing this swiftly evolving industry, but it also can make it seem like a scam.

Enter stablecoins. The advent of stablecoins has paved the way for more people to enjoy the benefits and efficiency of digital currency without risking the total value of their funds to market fluctuations.

In recent months, stablecoins have gained enormous traction among both new and seasoned cryptocurrency users. While stable tokens don't necessarily embody the same features of earlier cryptocurrencies such as Bitcoin and Ether, they're a step ahead when it comes to making people and businesses feel comfortable transacting with digital currency.

As we look beyond the traditional finance landscape towards a digital decentralized future, it is important that more people learn how they can use digital currencies, including stablecoins, in their everyday life.

The possible uses of stablecoins are endless. We asked some of our favorite innovators and thought leaders how they use stablecoins to improve their lives and businesses and we're absolutely floored by the all the clever ways people are taking advantage of this new asset class. We've compiled these "hacks" for you and we'll be sharing them in coming weeks.

Understanding Stablecoins

Stablecoins are a new class of blockchain-based digital currencies that are generally backed by fiat currency reserves such as that of dollars or euros. In some cases, they are also backed by other assets, like gold. Thus, stablecoins maintain an approximately 1:1 price ratio with the fiat currency they are backed by, acting as a digital clone of the currency we are habituated to.

As stated, the biggest benefit of stablecoins is that their price is, well, stable. Whatever your experience level with digital assets, you can safeguard yourself against the volatility of crypto markets by storing your funds in stablecoins.

Now, let's dive into our first stablecoin hack.

Stablecoin Hack #1: Upload your money to the internet (for free)

Our first hack comes from founder and CEO of Gilded, Gil Hildebrand. Gil says the ability to convert your bank dollars into cryptocurrencies for free by exchanging them for stablecoins is one of his favorite ways to use stablecoins.

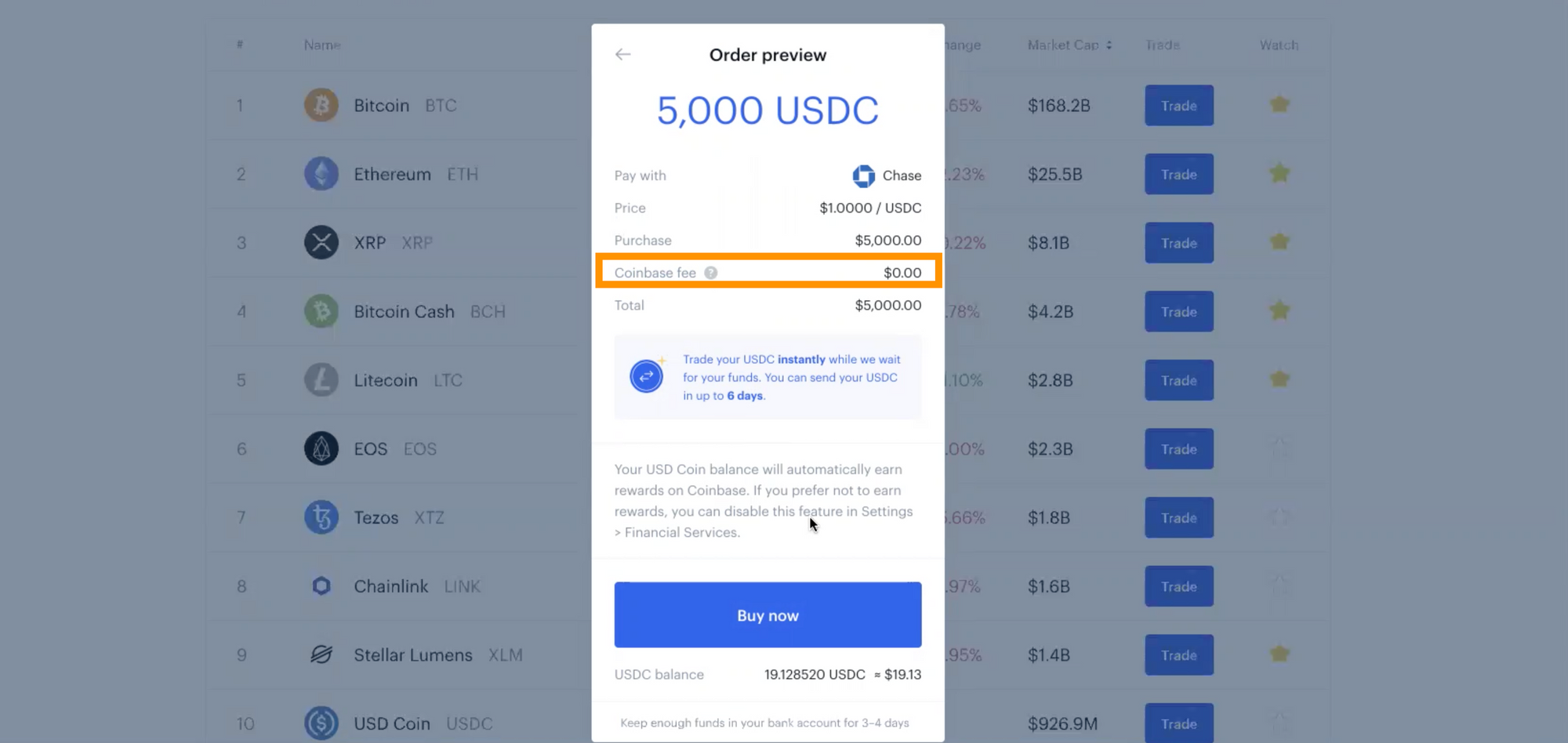

When you buy cryptocurrencies like Bitcoin or Litecoin through a crypto exchange, the platform deducts a conversion fee between 0.25% to 1% from your total deposit. The fee they charge is how they generate revenue from their platform.

The revenue of stablecoin issuers is generated from interest earned by holding your dollars in their bank accounts. The more dollars you exchange for a stablecoin, the more profits they collect from your funds. This business model means that exchanges can cut out the fee for converting your dollars into crypto.

If you want to try out for yourself, all you have to do is log in to a cryptocurrency exchange that issues a stablecoin—such as Coinbase. In Coinbase, enter any amount you wish to convert to the USDC stablecoin and click buy.

If you enjoyed this first stablecoin hack, stay tuned. There's plenty more where that came from.