QuickBooks

A collection of 6 posts

ABOUT US

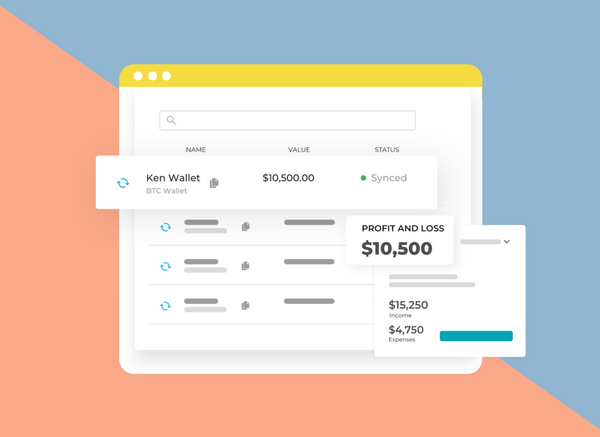

We're a team of developers and CPAs who believe that the future of finance is global, open and powered by blockchain. Our cutting edge software simplifies payments and accounting for global businesses with both crypto and traditional finances.