Updated April 20, 2023

Crypto accountants have a problem.

QuickBooks does not natively support crypto assets.

The process for categorizing crypto in QuickBooks can take five times longer than the process of accounting for traditional income, expenses, assets, and liabilities.

Also, manually categorizing crypto assets in QuickBooks is fraught with risks for mistakes on valuation and general ledger account assignation.

Obviously, you want to keep using the QuickBooks software system.

QuickBooks is the #1 accounting software for SMB’s, with an 82% market share and is feature rich for most businesses.

There's a simple way to solve this crypto categorization problem and keep using QuickBooks software.

In this post, we’ll explore two ways to categorize crypto in QuickBooks — with Gilded’s Crypto Accounting Software, or by doing so manually.

Accounting and blockchain follow the same logic

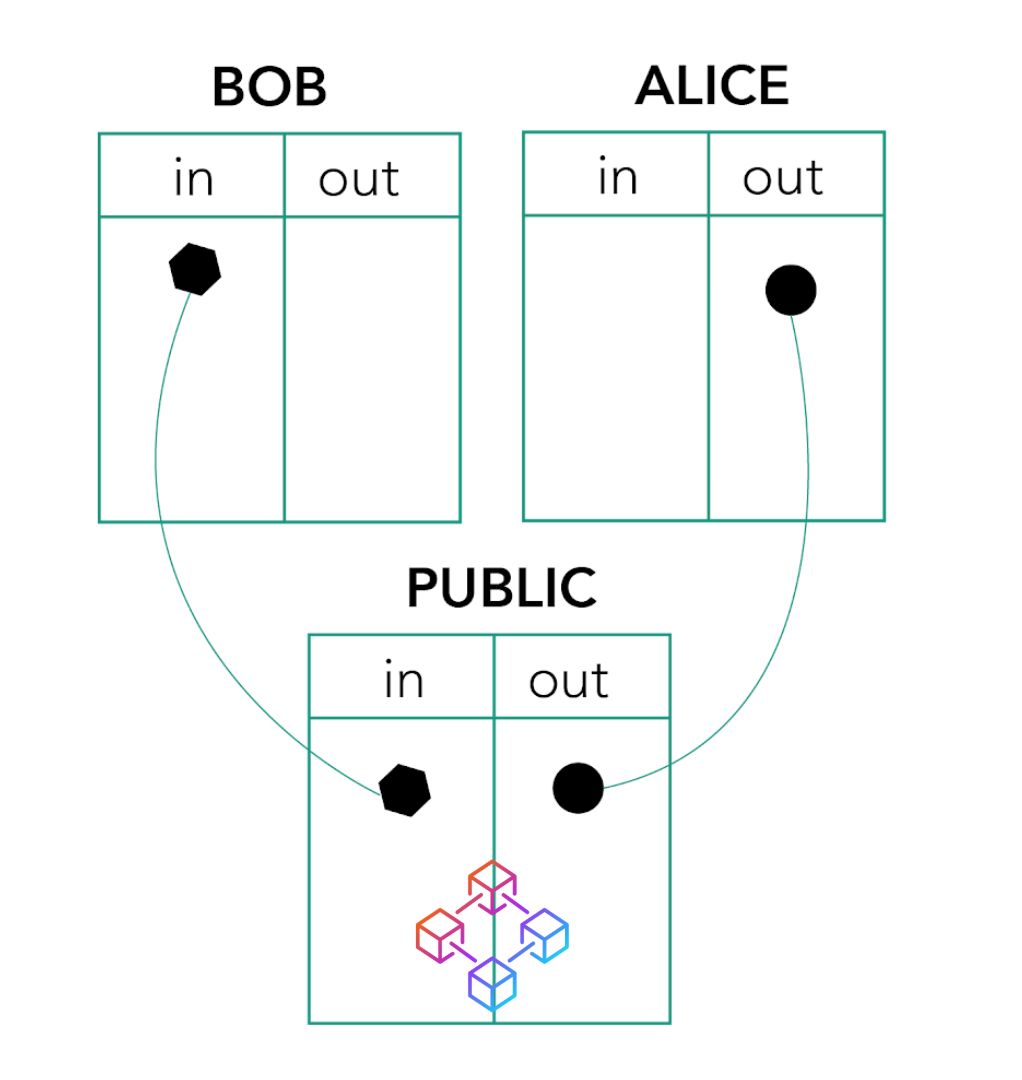

Blockchain is a system of triple-entry bookkeeping.

Blockchain transactions exist on a public ledger system that automatically calculates transactions as they take place in real-time.

If you send, or receive, a quantity of Bitcoin (or some other kind of digital asset) to another business, the transaction will appear on a public ledger.

But raw blockchain data lacks clear context and block explorer links do not provide accounting-grade information for your record keeping and for any subsequent proof of transactions.

Lack of transparency makes it difficult to integrate blockchain transactions into your accounting system in a way that can help you make sense of the details.

Blockchain is advancing the field of accounting as transactions populate in real-time.

But that's not the end of it.

Raw blockchain data lacks context and block explorer links do not provide accounting grade information.

That's where crypto accounting software comes in — allowing you to enrich, classify, and tag crypto transactions and create a journal entry in QuickBooks.

One of the most important features of crypto accounting software is the ability to organize financial information in a clear way.

You can use a customizable dashboard, the ability to map contacts, the option to manage multiple crypto wallets, and integrations with accounting software like QuickBooks Online, NetSuite and Xero.

As you optimize your crypto to QuickBooks workflow, the more time you’ll have to focus on actually advising your clients.

Can QuickBooks even handle cryptocurrency?

Crypto works in QuickBooks, but there are clear limitations.

As examples:

- QuickBooks only supports two decimal places. For cryptocurrency

accounting, this is an issue because coins like Ethereum can have up to 18 decimal places. - QuickBooks does not allow you to link your crypto wallets. If you have a high-volume of transactions to track down, this can become extremely burdensome to manually upload each transaction to QuickBooks.

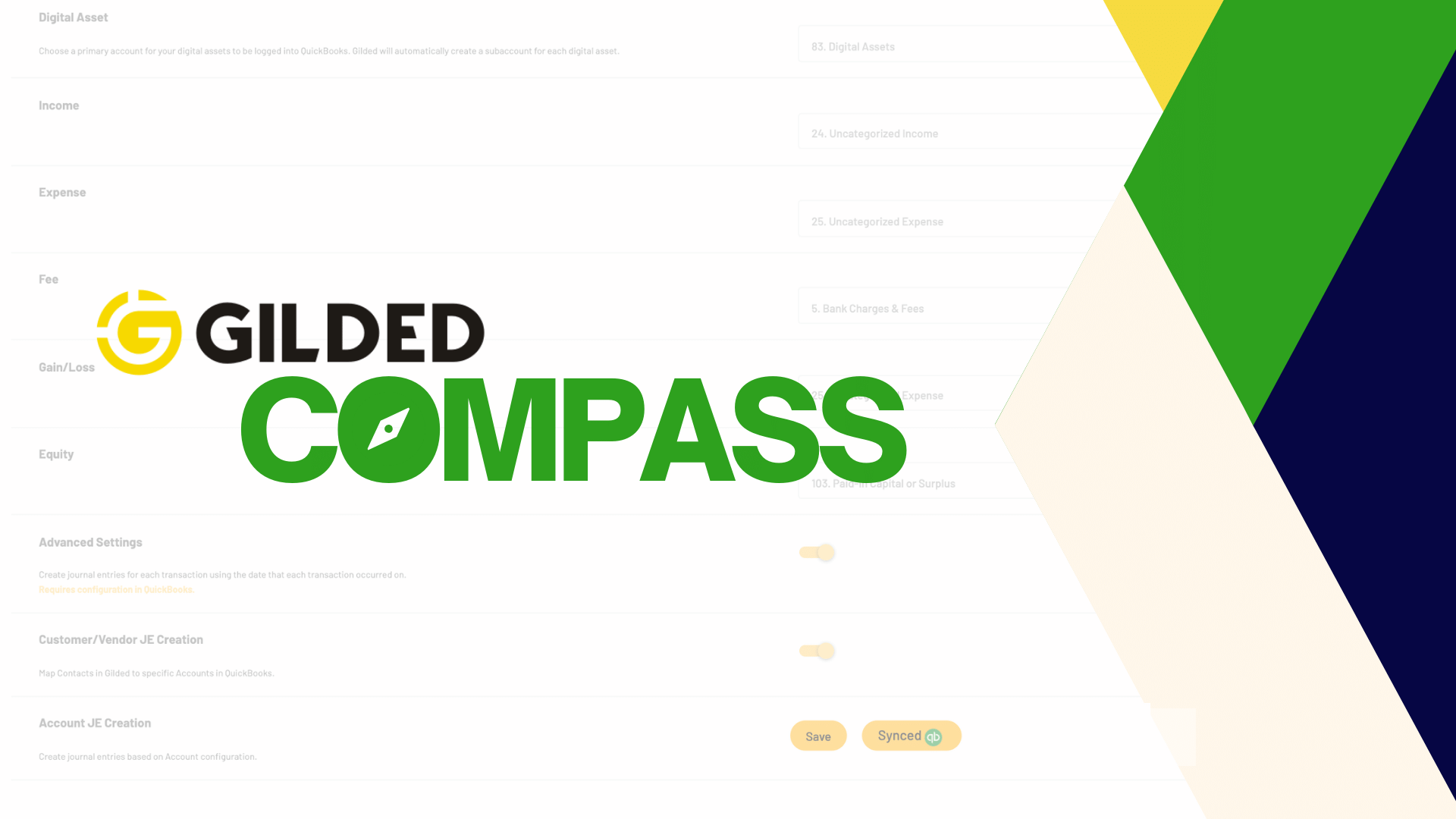

How to categorize crypto in QuickBooks with Gilded's crypto accounting software

After this section, we will show you how to manually categorize Crypto in QuickBooks, but first let's simplify your life.

There’s an easier, faster, and less expensive way to categorize your Crypto in QuickBooks.

With Gilded Crypto accounting software, there are just three steps.

Step 1.

In the Gilded app, you’ll click to add your digital wallet to Gilded.

At this point, your records of digital assets, as well as your entire history of transactions, will begin to upload into your Gilded account.

This information will be saved and will be accessible each time you log into your account.

Gilded allows you to view all your crypto wallets and transactions in one place.

Your portfolio of digital assets and transaction history will be available to use with a variety of payment and accounting tools.

This includes Bitcoin, Ethereum, Polygon, and a variety of other cryptocurrencies.

Step 2.

Rather than having to calculate every change in coin value by hand, Gilded’s interface will run the numbers by using third-party data sources, allowing you to import valuations into the QuickBooks general ledger, streamlining your entire accounting process.

Gilded's robust spot pricing engine verifies the price of the Crypto currency at the moment of the transaction and ensures the related fiat numbers are correct.

Step 3.

Next, you’ll be able to automate transactions and customize your financial reporting in a few clicks.

Gilded allows you to automatically map contacts and wallets to a specific chart of accounts in the general ledger and click on “Sync with QuickBooks” to perform a one stroke task to integrate and account for your transactions.

Of course, you can use an easier way to categorize crypto in QuickBooks Online.

With Gilded, there are basically three steps.

Once you have added all your wallets to the Gilded software, your digital assets, as well as your entire history of transactions will begin to load onto your Gilded account.

This information will be saved and will be accessible each time you log into your account.

Your portfolio of digital assets and transaction history will be available to use with a variety of payment and accounting tools.

This includes Bitcoin, Ethereum, Polygon, and a variety of other cryptocurrencies.

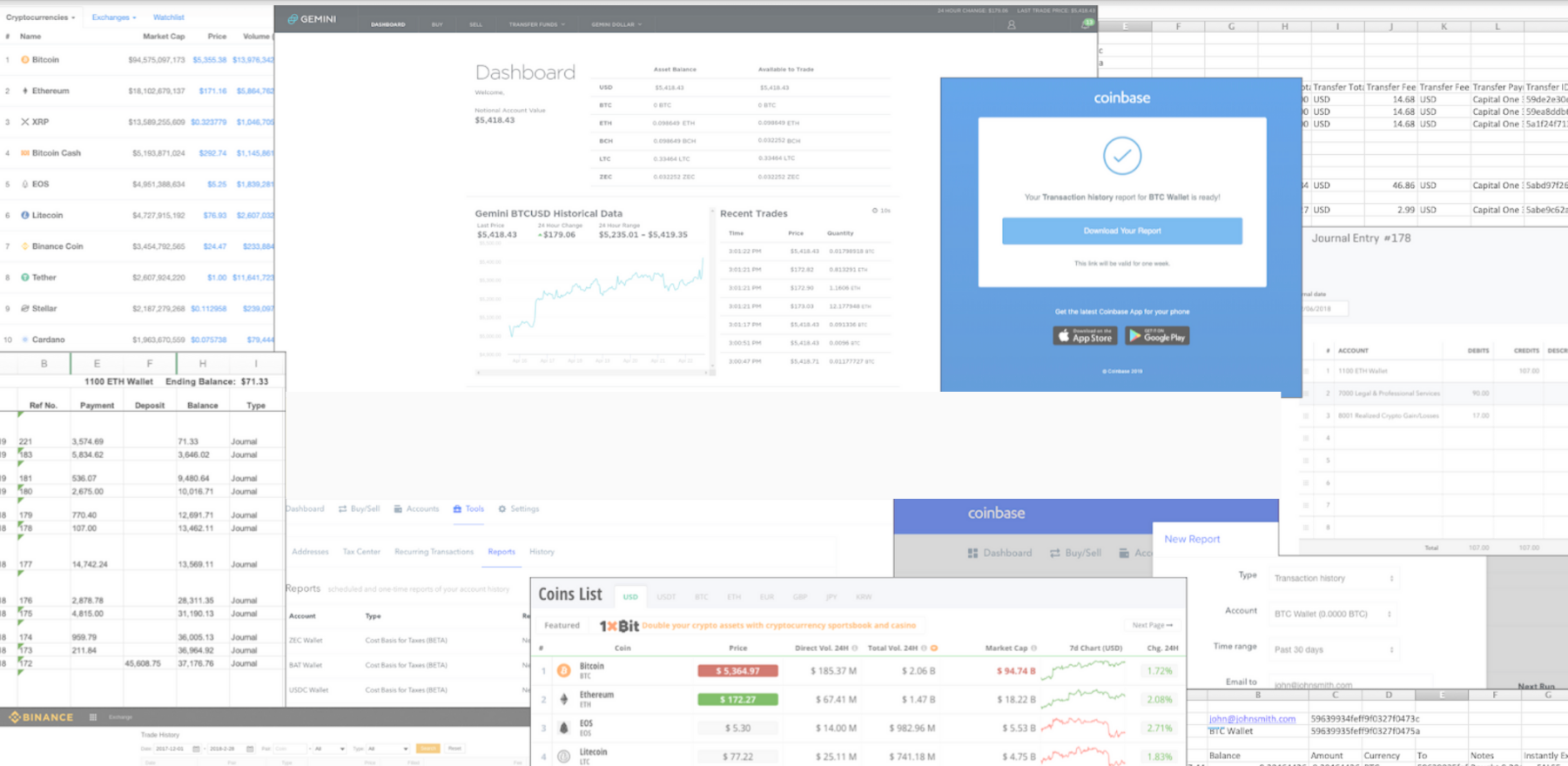

How to manually categorize crypto in QuickBooks

The process of accounting for cryptocurrencies in QuickBooks will overlap with the way you account for other assets.

If you are accepting crypto and recognizing revenue in the form of digital assets, you’ll want to have an asset account for your crypto holdings that’s separate from your bank account asset accounts.

Likewise, expenses paid using cryptocurrencies should be shown as a credit to those asset accounts — but you’ll need to convert and then track them in your base fiat currency.

Converting valuations manually to fiat values will require asset price conversions prior to creating entries, which should be done at the spot price of the cryptocurrency on the day it is received.

You will need to create a general ledger account to best track this information.

And invariably, if you invoice someone in Crypto, they will either remit in fiat at a different conversion price than when you billed them (causing you to adjust your internal fiat transaction value) or use a wallet exchange that subtracts out fees that are not advantageous to you.

This necessitates that you adjust accounts receivable accounts for reduced asset values and reduce revenue due to lower fiat value of collections, net of expenses.

How do I add crypto manually to QuickBooks?

QuickBooks doesn’t have a standard way to account for cryptocurrencies.

Your best choice is to maintain your own record of this information on a separate ledger sheet.

You can keep notes in the memo section, including the names and quantities of the assets you're transacting.

You’ll also want to maintain a separate ledger account for your gas fees.

Although it’s possible to track these fees on-chain, you should dedicate a separate account in the general ledger within QuickBooks, since it’s considered a qualified business expense.

You’ll also want to create a record for each outgoing transaction.

And then you can manually upload the data into QuickBooks.

As you can see from above, manually accounting for crypto assets involves multiple steps with multiple moving parts that are slow, manual, and subject to interpretation and variation.

As accountants, we don’t like phrases like “slow”, “manual”, and “subject to interpretation and variation.”😁

Final thoughts

Although it's possible to categorize crypto in QuickBooks without a third-party application, Crypto accounting software like Gilded makes the process much easier.

You can keep using QuickBooks, integrate the Gilded crypto accounting software and speed up, simplify, and remove transaction accounting risks in one easy process.

Related reading

Connect with us on Twitter and LinkedIn.