(And How Accounting Firms Can Make the Transition To Web3)

It's no secret that accounting firms are having trouble finding employees. Upon earning the CPA certification, former students are finding opportunities in sales, technological development, and customer support.

Everywhere except for accounting.

Cryptocurrency is on the minds of younger people. Veterans of accounting might see bitcoin as merely an investment — not much different than TSLA or GME. On the other hand, many young professionals are more interested in accounting jobs in crypto.

And they’re not finding them in the more traditional firms.

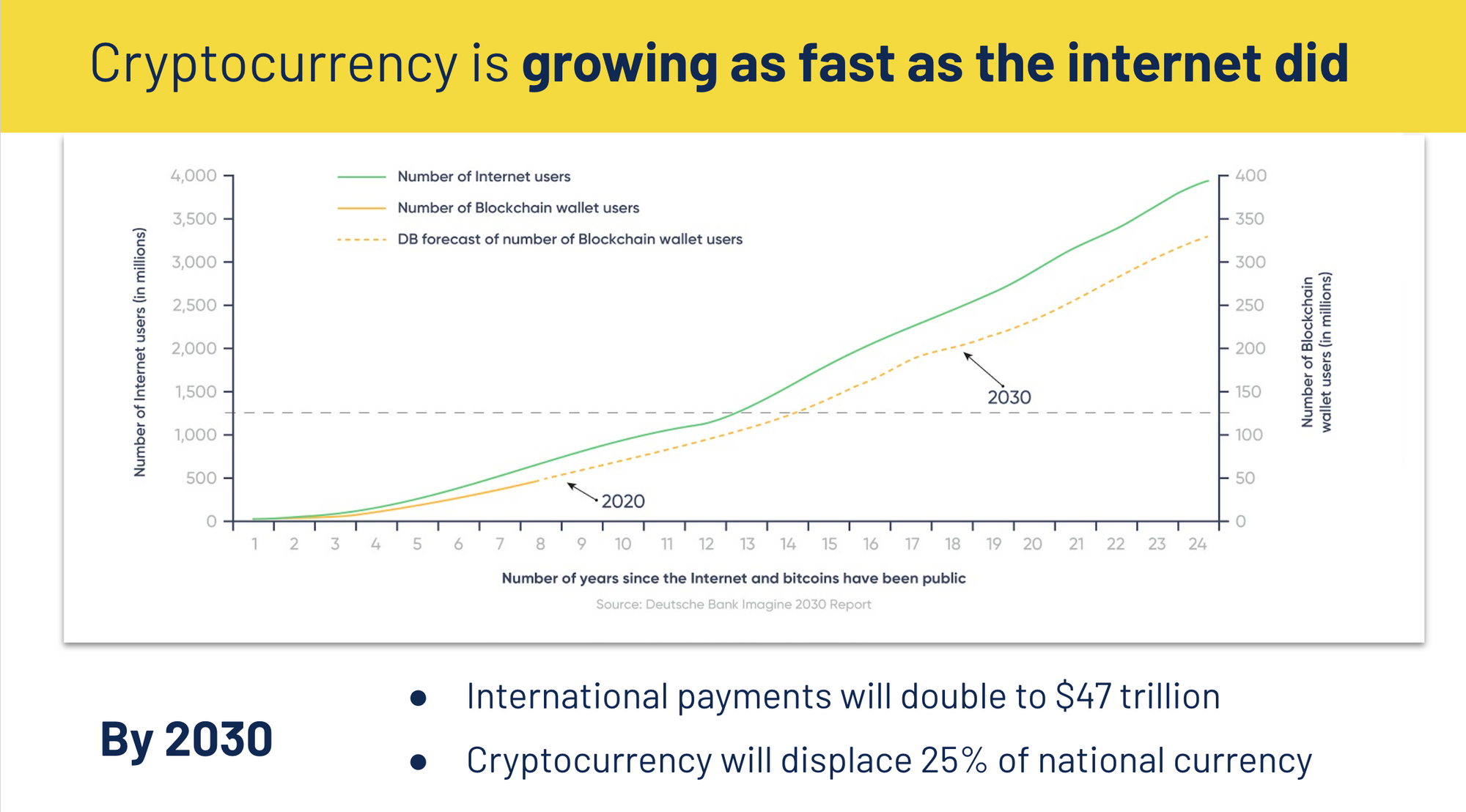

This new generation of professionals realizes the potential of crypto. They were college students when bitcoin and Ethereum became household names. They see cryptocurrency and blockchain — not as a phase — but as a technological revolution that will impact every aspect of life.

We agree.

In fact, one of our favorite things at Gilded is onboarding clients who are just beginning their crypto journey. It’s not as difficult as you might imagine to connect the dots and discover how decentralized technology is forging its place in the world.

In this guide, we'll focus on the types of accounting jobs available in crypto, what you need to know to work in crypto as an accountant and how to find those jobs, and how accounting firms can make the transition and thrive in the web3 economy

What kinds of accounting jobs are available in crypto?

These are jobs where the accountant is working directly with cryptocurrency – whether that’s in crypto mining, NFT revenue, DAOs, or any of the myriad of various web3 use cases.

We know that crypto will become a fundamental part of the economy. Most jobs in accounting will eventually fit into this category.

Currently, the supply of crypto accounting jobs is more limited. However, the possibilities are as wide-ranging as accounting jobs in traditional finance.

Businesses that require a crypto accountant might include:

- An e-commerce business that accepts bitcoin or ethereum

- A company that transacts in stablecoins for international exchange

- An NFT studio looking to release its next project

- A DAO paying their contributors in their native token

- A DeFi project diversifying and managing their treasury

The crypto accountant is there to help manage a client’s digital assets. They could be employed by the business they’re assisting. They could also be hired as an outsourced accountant or a member of a larger firm.

As decentralized technology continues to grow, with it we’ll see a massive increase in crypto accountants. There is already a huge demand for professionals that know how to account for digital assets.

Technology is changing jobs in accounting

We already know the Generally Accepted Accounting Principles (GAAP) change often enough. The Federal Accounting Standards Board (FASB) releases new rules on a nearly annual basis. This is to accommodate changes in legislation, and the emergence of new technology.

However, technology — blockchain, in particular — is creating a faster pace of change in the field of accounting.

Accounting jobs in crypto are emerging specifically to help account for changes related to decentralized finance.

The fundamental role of accountants isn’t changing. But, like changes in the past, accountants will be asked to shift their behavior in accordance with the emergence of new rules and general principles. Accountants who embrace this change (as well as those already deep in the crypto rabbit hole) will be poised to capitalize on this technological shift.

Going paperless

About fifteen years ago, the field of accounting decided to go "paperless". Most accountants had 8-inch briefcases to carry around from client-to-client. You’d have your briefcase, computer, and all of your paper. It wasn’t unusual to use a dolly to transport everything around.

It wasn’t convenient. It was just the way things were.

One day, the accounting industry said, “we have new software — we’re going paperless.”

This was a huge shift. Electronic accounting helped save time and energy. The most successful accounting practices were the ones that embraced the new changes.

This was around the early development of the internet. The way people did business was transforming and ultimately that seismic shift wouldn’t have been fully possible without electronic accounting.

A similar transformation is occurring today. The introduction of accounting jobs in crypto is reminiscent of the early days of the internet. This time, you’re being asked to interpret an entirely new class of assets — a whole new territory.

What you need to know to become a crypto accountant

As was the case in the early 2000s, the most important quality for accounting professionals is a sense of resilience.

Superficial changes are going to occur in the field of accounting. However, the fundamental responsibilities of the accountant will remain the same.

This means collecting and monitoring a company’s finances and advising them on important financial decisions.

Crypto accounting jobs will have the same prerequisites as traditional accounting. Aspiring accountants will likely still need a bachelor’s degree in accounting and your opportunities will greatly increase if you’re a CPA.

Again, it’s important to remember that crypto accounting is simply an extension of the same skillset you’ve deployed as an accountant in traditional finance.

Many accountants had a difficult experience going paperless — comparatively, learning to account for digital assets is easy and the software already exists.

Crypto accounting software

It's a good idea to have a working familiarity with crypto accounting software. For years, companies have relied on QuickBooks and Xero for their accounting needs.

But there's a problem.

Legacy accounting systems don't support cryptocurrency transactions.

That means that a crypto accountant must make a choice:

- Spreadsheets and manual processes that introduce the possibility of human error

- Deploying an entirely new accounting system

- Software that supports accounting for cryptocurrency and integrates with existing tools and processes.

Gilded's crypto accounting software integrates with QuickBooks Online and Xero— allowing you to use the tools you’re already familiar with to dive deeper into the next generation of accounting.

Whether you use Gilded or not, it's good to get a feel for the tools that can support your endeavors as a budding crypto accountant. Getting your feet wet with different systems will help determine what features of crypto accounting software are important to you and your practice.

Learning the lingo

However, a job in crypto accounting is going to be difficult if you aren’t familiar with the vocabulary of web3. To best navigate the technological changes, it’s important to get a grip on the language.

There's a lot of jargon, but fortunately, nothing speaks to blockchain like accounting. The blockchain itself is the decentralized ledger system that the different cryptocurrencies are built upon.

Bitcoin, Ethereum, and Polygon are just a few examples of different blockchain networks that exist. Every day, there are thousands of financial transactions on each of these networks all across the world.

Decentralized applications (or dApps) are built on the blockchain — they’re basically platforms that you connect to with your crypto wallet instead of logging in via username and password.

Don't let the semantics intimidate you. If you're not yet familiar with it, you'll pick it up very quickly — just like I did.

The best thing you can do to learn the principles of web3 is to set up your own crypto wallet and dive right in. Direct interaction with protocols will be your best teacher.

A word from one crypto accountant

Dr. Sean Stein Smith, CPA, is an assistant professor at Lehman College and Chairman of the Accounting Working Group of the Wallstreet Blockchain Alliance. He recognizes three patterns in the professionals that find success in the emerging field of crypto accounting:

1. “[The people] that are most interested, have the most fun on the journey, and have the best outcomes, are those that are generally interested in learning.”

2. "Trying to become an expert in everything, or become an expert overnight just isn’t possible; everybody I've met that has successfully pivoted has done so over years, as a result of continuous self-improvement.”

3. “The people that enjoy the large shift are the people that are not afraid to have fun. Mistakes happen, learning is not a straight line, but becoming a better and more well-rounded professional is always a rewarding process.”

A massive opportunity awaits. The journey to a job in crypto accounting should be both challenging and rewarding. Connecting with others is a great way to discover shared meaning and your own place in the world of crypto.

How to find a crypto accounting job

There are different avenues of approaching the social ecosystem of web3. You may find opportunities on job boards, on Discord or Telegram, or by building your own brand in crypto and marketing your accounting services.

Crypto job boards

Similar to websites like Glassdoor or Indeed, there are designated job boards to find positions in web3.

Cryptocurrency Jobs has the intention of “onboarding thousands into the crypto ecosystem.”

Crypto Job List encourages users to design profiles for prospective employers to see.

The sites aren’t specialized in crypto accounting jobs but you may find an accounting opportunity there. These sites include a wide variety of blockchain-related job opportunities — from positions in marketing, social media management, or development.

Networking on social media

If you’re looking specifically for a job in crypto accounting, it might come down to who you know.

It’s becoming more common for businesses to hire through social media. Twitter, Discord, and Telegram are some of the biggest platforms for this. Web3 also has a big LinkedIn presence. LinkedIn offers its own job search functionality that can be useful and will let you know if you have any contacts at a company you might be interested in.

Social media networks are certainly not blockchain specific, but blockchain people tend to be active on social media.

The best web3 conversations will emerge from spaces where everyone has a voice. These are some of the places where organic opportunities can emerge.

Building your personal brand

Web3 is a digitally native ecosystem. Now more than ever, it's important for professionals to market themselves with an online presence.

These days, marketing oneself online often takes the form of developing your own brand. Instead of relying on a resume alone (like in traditional finance), potential clients or employers will also refer to the accountant’s online presence to determine if they’re a good candidate for a job in crypto accounting.

Brand visibility gives accountants the ability to be more creative in how they search for work. The way you present yourself online is probably going to be considered by clients and employers alike and it's a good idea to make the most of it.

The good news is you don’t have to present yourself as a typical CPA. As you learn about the crypto space, you might discover a niche — whether it’s accounting for investors or DeFi protocols, and create an online presence that reflects that focus.

Whatever your focus, lean into it. I assure you that there are people that need your help.

How your accounting firm can prepare for web3

It’s clear that many accounting firm partners are just as interested in cryptocurrency as other professionals. Partners have a lot of freedom in terms of the directions their firm can go.

If you’re a partner who has a strong interest in something, your job is to build out the practice. You market yourself and find the clients that will help to attract business to your accounting firm. Positioning your firm towards web3 and crypto is a enormous opportunity for growth for an industry that hasn't otherwise changed much in decades.

Preparing your accounting firm for web3 is will overlap with an individual’s search for a role in crypto accounting.

This means building relationships with a new set of clients (and helping to onboard your current clients to using digital assets). You’ll want to develop an understanding of the vocabulary and use cases and build out your accounting firm as a brand in the crypto space. You might find new contacts in the crypto field who could become part of your firm.

Even if your firm isn't quite ready to accept crypto clients, it's important pay attention to new innovations in the world of web3 so you don’t fall behind.

A final thought

As you apply for jobs in crypto accounting, you’re probably both excited and intimidated by the possibilties. Although the language feels different, you probably love the feeling of being on the cutting edge of technological change.

It’s important to remember that we’re all new to cryptocurrency, relatively speaking. Even the project leaders haven’t been working in this space for more than ten or fifteen years. You're still early.

It’s important for accountants to claim their seat at the table and have a presence in the emerging field of crypto assets. Accounting represents stability in relation to the energy of entrepreneurs. The language and technology might change but ultimately, the role of accountant as a trusted financial advisor is going to largely remain the same.

Much of your success as a crypto accountant (or firm venturing into web3) will come from the people around you (or online). At Gilded, we recognize the importance of networking for accountants.

What do you do if your client has a particular request that you can’t help with? You refer them to a different accounting firm. How do you make sure your practice is running things correctly? You undergo a peer review by an accounting firm in your network.

Gilded's Accounting Partner Program

If you’re an accountant looking to enter the crypto space, we’d like to invite you to join our accounting partner program. We’re happy to become a sherpa and advisor throughout your client’s crypto journey.

You’ll be able to grow your value to your clients by offering crypto accounting functionality that isn't possible without Gilded. We’d like to help you grow your network as well — this means connecting with other crypto accounting practices.

Want to join our network of trusted crypto accounting professionals? Inquire about Gilded's accounting partner program today.

Related reading

Founded in 2018 by a team of developers and CPAs, Gilded believes that the future of finance is global, open, and powered by blockchain. Our mission is to onboard the next million businesses to web3 by providing the financial tools to succeed in this new reality. Backed by Techstars and the Association of International Certified Public Accountants (AICPA), Gilded powers operations for companies building in web3.