QuickBooks is one of the most widely-used traditional accounting solutions for crypto companies.

But accounting for bitcoin in QuickBooks can be difficult, time-consuming, and complex.

With more and more organizations holding bitcoin on their balance sheet or paying employees in cryptocurrency, it's important for accountants and finance teams to properly account for bitcoin transactions in QuickBooks.

Gilded’s crypto accounting software solves these challenges so you don’t need to worry about accounting nightmares later on.

QuickBooks for Bitcoin

In today’s cryptocurrency-forward world, it's wise for accounting pros to learn how to track bitcoin transactions in QuickBooks in order to maintain accurate financial records and operate with confidence.

In this article, we'll provide a guide on how to add and track bitcoin transactions in QuickBooks, including instructions for using crypto accounting software like Gilded to automate the process.

Whether you're a seasoned accountant brand new to crypto or a longtime bitcoin hodler, this guide will help ensure that you're properly accounting for bitcoin in QuickBooks.

Can you track Bitcoin natively in QuickBooks?

For a variety of reasons, QuickBooks does not natively support tracking bitcoin transactions, as you cannot sync a bitcoin wallet directly to QuickBooks.

However, you can add bitcoin as a currency in QuickBooks, create a Chart of Accounts for your bitcoin transactions, and manually add invoices or bills (more on this below).

So why is tracking bitcoin in QuickBooks difficult? There are two primary reasons:

- Importing Bitcoin block explorers. Bitcoin block explorers, where you can publicly see each transaction, do not allow you to search and import transactions into QuickBooks. Because of Bitcoin’s innate privacy features, it makes it difficult to export transactions without third-party software.

- Two decimal point limit. QuickBooks does not handle more than two decimal points. This makes it challenging to incorporate crypto transactions that have many decimal points and is the biggest issue with tracking bitcoin in QuickBooks.

Both of these issues can be solved with crypto accounting software — but first, let’s take a look at how you would attempt to account for these transactions solely within QuickBooks.

Note: you can manually add other types of crypto transactions to QuickBooks from the Ethereum blockchain, but it’s more cumbersome and time-consuming than using an automated crypto accounting solution.

How to track bitcoin in QuickBooks

When dealing with bitcoin in QuickBooks, everything starts with your Chart of Accounts.

In order to understand the flow of funds in your bitcoin wallet, you will want to have an account that is specifically set up for bitcoin. For each of your bitcoin wallets (and any other cryptocurrency wallet or exchange), create a separate account in the Chart of Accounts in QuickBooks.

First, set up the bitcoin (BTC) currency in QuickBooks:

Navigate to Settings > Currency > Add Currency, and set the current exchange rate to the USD equivalent.

For example, if bitcoin is currently valued at $17,000, you would set USD to $17,000. (Note: if you send invoices, you will want to change the exchange rate every time you resend the invoice or when reconciling). This becomes cumbersome as you send more invoices because bitcoin is constantly volatile. There’s a simple solution for this problem, discussed below.

Next, let’s take a look at how to set up your Bitcoin Chart of Accounts within QuickBooks:

- In QuickBooks, navigate to Accounting on the left sidebar > Chart of Accounts.

- On the right side, click New to set up a new Account.

3. Click Asset and save the account + tax form section as Other Current Assets. You can name the account whatever you want, but we recommend naming it Bitcoin Account. Lastly, choose Bitcoin BTC as your currency.

Note: If you want to add expenses and revenue to this Account, you will want to save bitcoin as a Bank asset instead.

4. Choose Other Current Assets as the account type and enter Bitcoin as the account name. Click Save and Close to create the account.

5. Depending on your use of QuickBooks for bitcoin transactions, you will add new invoices or receive payments in bitcoin within QuickBooks.

Based on these transactions, this will change what you see in your Balance Sheet (located in Reports) or your P&L statement.

Another reminder: QuickBooks only allows for two decimal places, so it’s difficult to record bitcoin transactions accurately since bitcoin contains eight decimal places.

By following the above steps, you can begin to (albeit in a cumbersome manner) manually account for bitcoin transactions in QuickBooks and track the value of your bitcoin holdings in your financial records.

You’ll also want to discuss with your CPA how you want to account for the valuation and inflows and outflows of bitcoin and select a FIFO, LIFO, or HIFO method.

Using bitcoin within QuickBooks is indeed possible

Most experienced crypto accountants have found a faster, easier, and more efficient method.

How to record Bitcoin in QuickBooks Online with Crypto Accounting Software

Gilded is the #1 crypto accounting software solution integrated to QuickBooks, according to the QuickBooks app store. We have wide-ranging features with invoices, billing, and automated mapping of transactions to your Chart of Accounts in QuickBooks.

Gilded has the most advanced QuickBooks sync for Bitcoin on the market.

Here’s how recording and syncing bitcoin in QuickBooks is simplified with Gilded:

- Request a demo with Gilded and register for a Gilded account.

2. Add a bitcoin wallet or exchange account to Gilded. Click Add Account in the Accounts section of the top navigation bar. Your transactions will begin populating and historical data will show in Gilded.

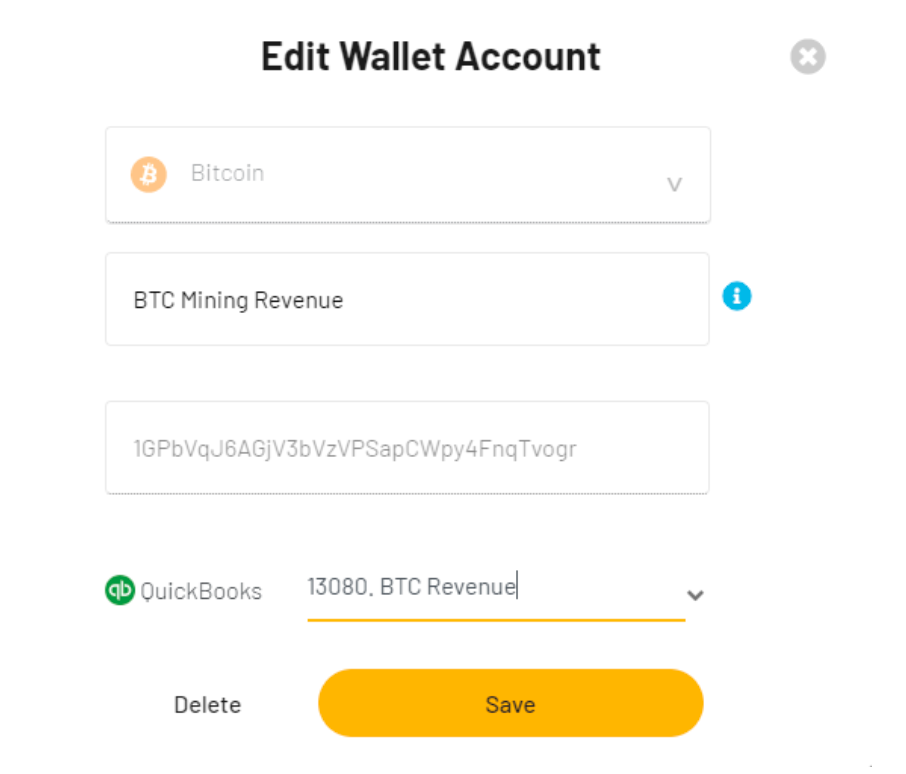

3. Navigate to QuickBooks. Create an asset account within QuickBooks for each one of your wallets (i.e. Bitcoin Income, Bitcoin Treasury, etc.)

4. Map the wallet to its corresponding asset account in QuickBooks. When you click sync to QuickBooks, assets are separated by wallet.

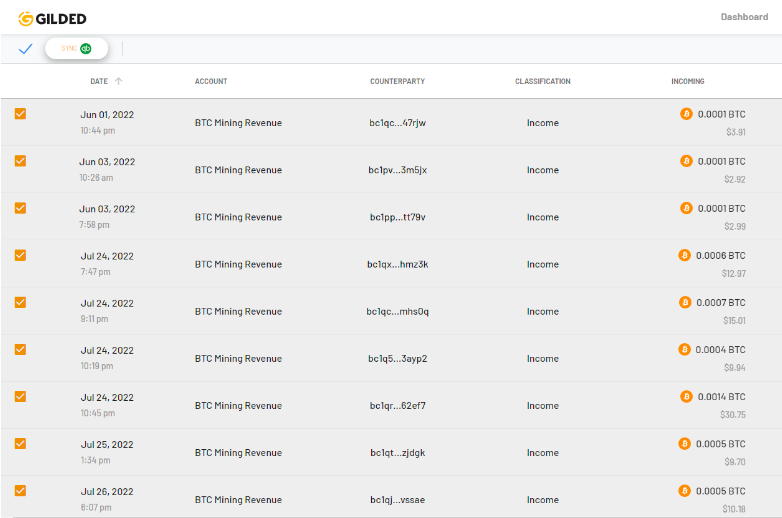

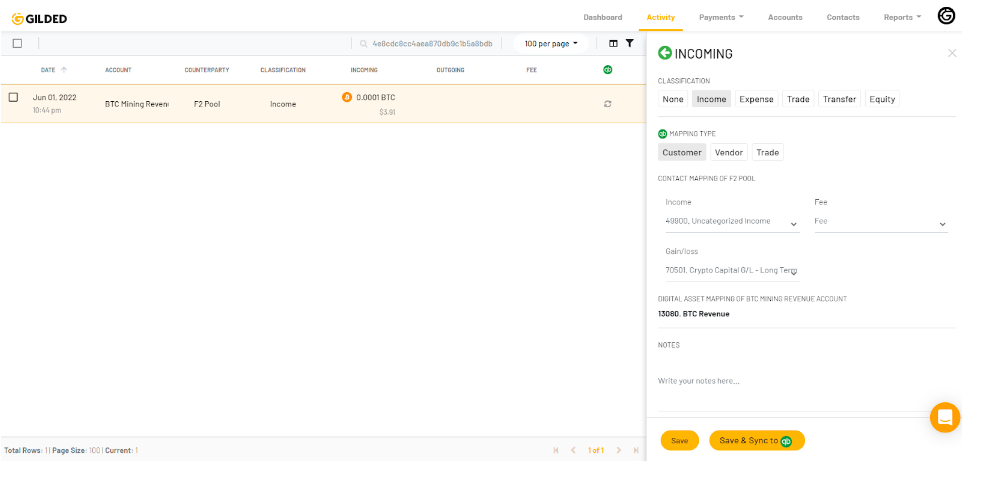

5. Select the bitcoin transactions to sync to QuickBooks. You will be able to: make notes, attach files, classify as Income or Expense, map to the appropriate chart of accounts in QuickBooks, and sync your transactions.

6. Gilded uses the FIFO methodology for tracking the cost basis of your bitcoin transactions before syncing to QuickBooks.

7. Click Sync to QuickBooks, and Gilded will notify you on the page when the sync is finished.

Each of your bitcoin transactions will now accurately be reported in the correct account in QuickBooks.

Instead of adding transactions manually (and introducing the possibility of human error), you will automatically be able to sync your bitcoin transactions to QuickBooks.

A final word

It’s more important than ever before to ensure your business is accurately reporting crypto transactions. For many businesses, that means using QuickBooks (or another accounting software) to report your revenue, expenses, and investments.

As discussed above, you can attempt to record these transactions manually. However, it’s a cumbersome process, wastes your time, and you run the risk of inaccurate reports.

By using Gilded, you can streamline the process of tracking bitcoin and other cryptocurrencies in QuickBooks and generate reports on your holdings and transactions.

Crypto accounting software can help you better understand the financial impact of your cryptocurrency holdings and make informed financial decisions for your business.

Most importantly, you'll have an easier time reconciling your bitcoin and crypto transactions in each financial period (and not experience accounting nightmares later on).