Paying contractors or vendors in crypto? You'll likely to need file 1099s with the IRS. We've got you covered.

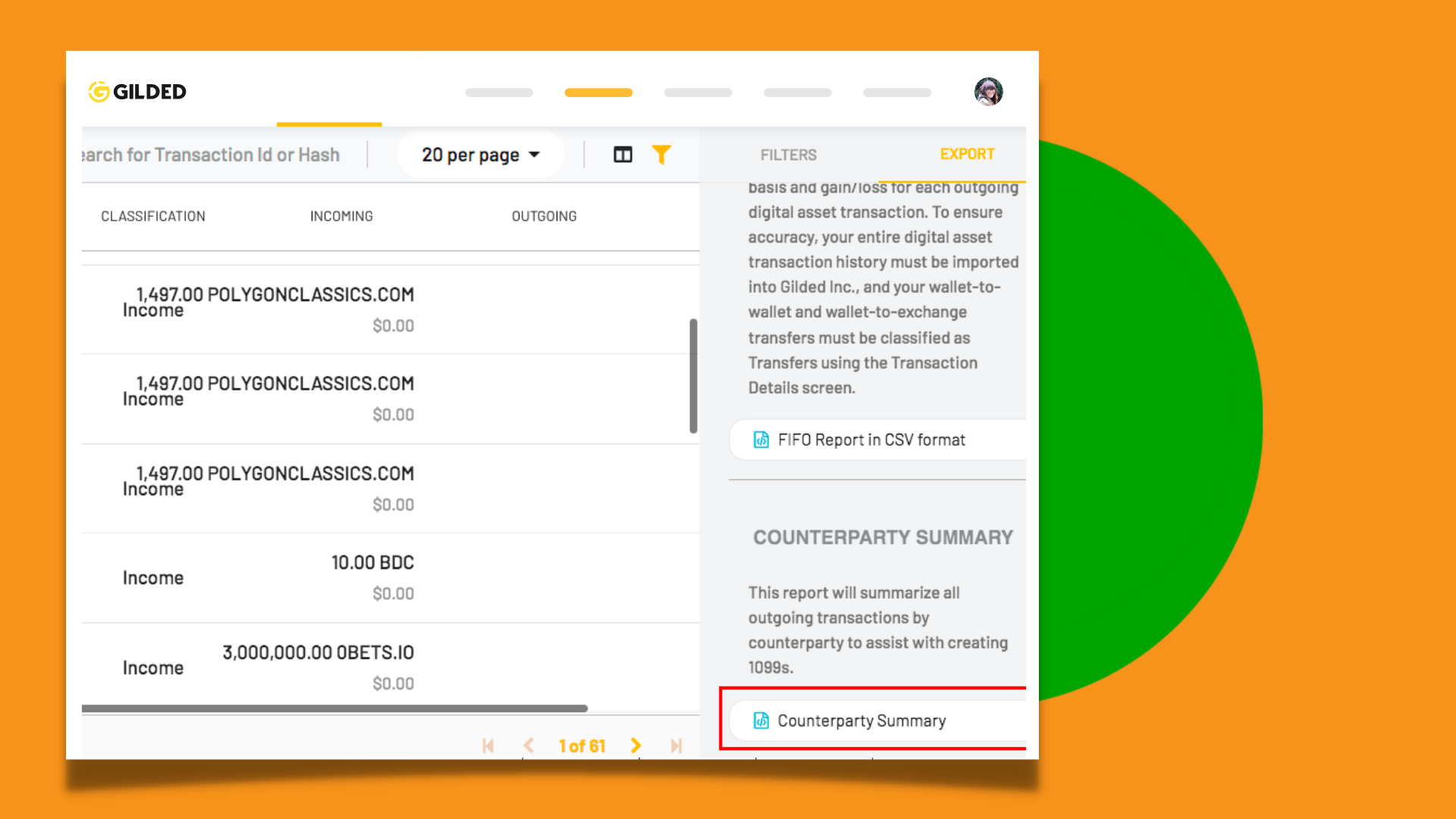

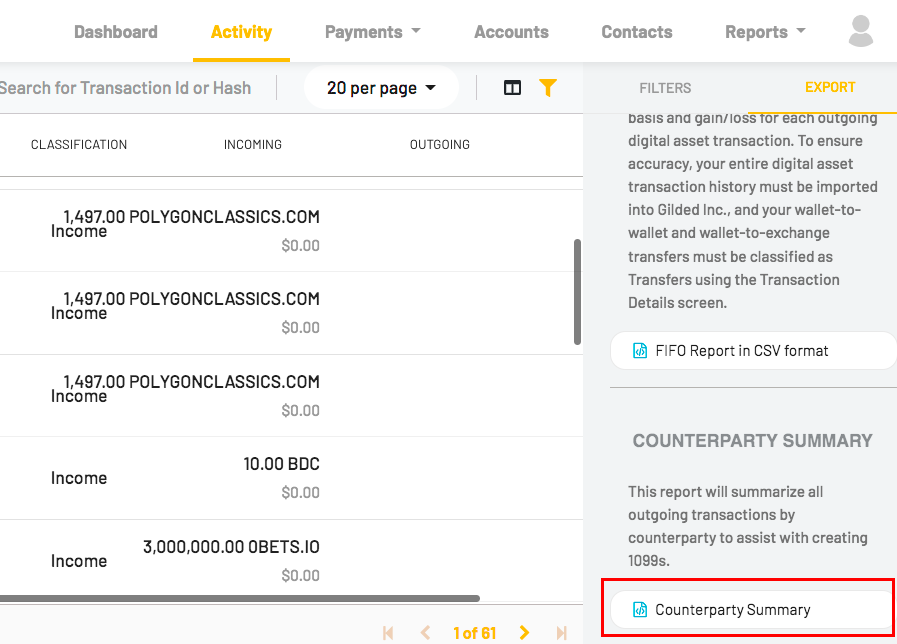

Introducing the Counterparty Summary

Gilded's new Counterparty Summary makes tracking expenses a breeze. Manage 1099 reporting and expenses with Gilded, so you can be sure all payments and expenses are accounted for come tax season.

Don't have 1099 requirements? That's ok. This new functionality makes it even easier to keep an eye on where your funds are going.

In a few clicks, you can run a report in Gilded that allows you to see a summary of payments based on the counterparty and date range selected.

Previously, in order to retrieve this information, you would have to painstakingly associate every Expense journal entry with a Company name in QuickBooks. This is a huge hassle and introduces the possibility of human error.

Paying contractors in crypto? Run the Counterparty Summary to see your expenses for each contact you pay and then attach that information to your 1099 tax form. Want to see how much you’re paying a specific business over time? Run a Counterparty Summary.

This functionality is best for:

- Organizations that need to file 1099 reports

- DAOs paying contributors in the USA

- Any company that pays people in crypto

Gilded's Counterparty Summary is now live on all Gilded accounts.