Sending invoices in crypto and accepting crypto payments manually can be time-consuming, difficult to track, and risky.

Worried about costly crypto invoicing errors, and spending hours integrating your transactions into accounting platforms like QuickBooks? Fear not! There are tried-and-true methods that can help you streamline the process.

When you simplify your day-to-day crypto workflow you'll be free to focus on more important financial reporting matters. And you won’t have to worry about critical invoicing mistakes, transaction reporting, or gaps for tax filing later on.

By the end of this article, you will understand the ins and outs of crypto invoicing, the issues with the old way of manual crypto payments, and how you can simplify the crypto invoicing process with best practices and tools.

Can you invoice in crypto?

Yes, you can invoice in crypto if you are accepting cryptocurrency for your business.

Accepting crypto payments from your clients grants your business a world of new financial opportunities as well as reliable global access, no matter the time or day. Instead of worrying about expensive international wire transfers and bank holidays impacting your payment schedule, with crypto you receive virtually instant payments 24/7 with lower transaction fees than wire transfers. Additionally, blockchain technology allows you unparalleled visibility into the flow of funds.

Once you’ve decided to accept cryptocurrency, you will want to keep your incoming revenue organized with invoices.

You could create invoices manually, but this introduces several problems.

The biggest problems with crypto invoices

Why is the process of manually sending invoices in crypto confusing, time-consuming, and difficult to track?

There are multiple steps in the process (as shown below).

Here are the eleven steps necessary to manually generate a crypto invoice:

- Put the invoice details into a PDF document or message, and then attach the crypto wallet address with the amount owed in an email.

- Send the invoice to your client.

- The client then finds the most advantageous conversion price they can find (i.e. if they pay you in ETH, they will find the best conversion rate).

- The client copies and pastes your wallet address and sends payment with the desired amount from their wallet.

- The client then replies to your email confirming the payment was sent.

- You check your wallet to make sure you received the funds.

- You then notify your client of the receipt of payment.

- You then try to match the crypto transaction information to your clients invoice.

- You then update the client’s invoice balance.

- You then notify your client of the receipt of payment.

- Finally, you manually enter the information into QuickBooks or your accounting software.

This process is time-consuming, involves multiple tools, and relies on human entry of accurate data at several points in the process.

In addition to wasting time, there is the possibility of inaccuracy in each step. The risk of inaccuracy in receiving the payment from your customer is no small issue.

Suppose your client accidentally sends crypto to the wrong address or miscalculates the amount you are owed.

Remember that crypto transactions are irreversible. If you are relying on humans not to make user mistakes, it’s only a matter of time before there are costly errors.

Often, inbound payments are confusing as to who sent the payment.

Most accountants end up trying to match the transaction to a specific customer and then manually enter that data into their accounting software.

And once you send the invoices, how do you incorporate these transactions into your accounting software?

Without third-party crypto accounting software, it’s cumbersome to integrate these invoices directly into your financial reports and be confident that you are accurate.

Simplifying the process

Implementing an automated crypto invoicing solution can simplify your payment process, so you can focus on delivering value to your customers.

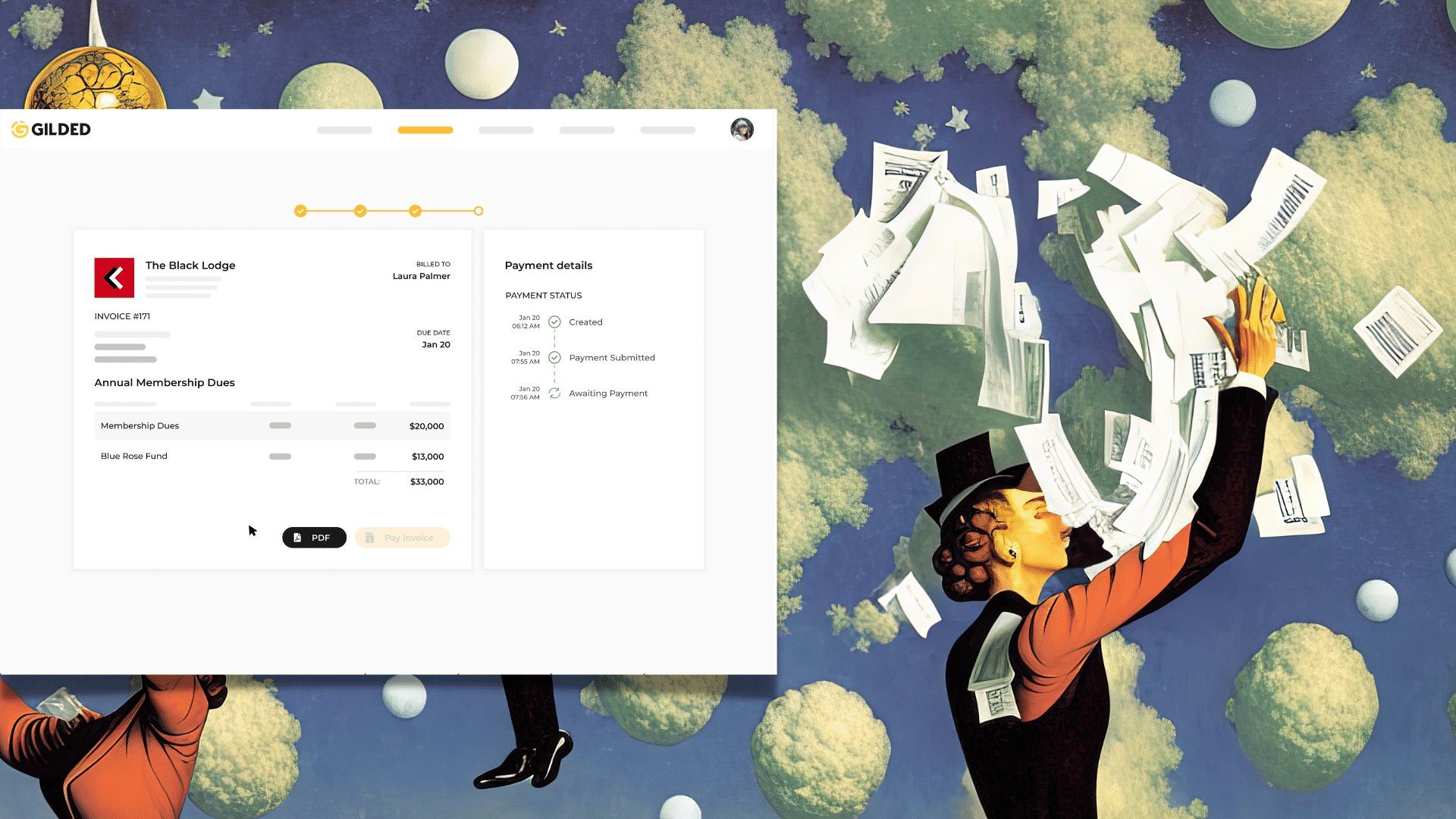

With Gilded, you can send invoices in crypto or fiat currency in seconds and get notified automatically when the invoice is paid.

Gilded's invoicing solution just takes a few steps:

- Create the invoice in Gilded priced in your fiat currency (with 16 different options) or cryptocurrency.

- Automatically email and/or share a link to the invoice in Telegram, Discord, etc., to your client.

- Client clicks pay with their desired wallet, at the conversion rate of the time of the bill.

- Client signs and completes transaction with their wallet.

- The invoice is updated as it is paid in real-time, also updating the customer’s invoice, confirming that payment was received. Transactions are recorded in Gilded and can sync to QuickBooks at click of a button.

With Gilded, you spend exponentially less time invoicing and receiving payments. And if you’re using Coinbase, you can receive the payment directly to your Coinbase account in BTC, ETH, or USDC.

Payments are received and can be synced to QuickBooks at the touch of a button.

You can create programmable, recurring invoices to send to your payors on a weekly, bi-weekly, monthly, or annual basis.

You will simplify your accounts receivable and invoicing process to focus on more important matters in crypto accounting.

And with comprehensive support of 30+ cryptocurrencies, you can have your clients pay you in whatever coin you choose while setting the correct rate in your base currency.

Customers who have tried the manual approach and then use Gilded are delighted by the simplicity:

Invoicing with Gilded has been incredible. I can create an invoice, send it to a client via Telegram, and I get paid that afternoon. It's just handled. Sending invoices so quickly and easily allows me to send the invoice while the matter is still top of mind for the client, so the value is front and center. With the clean interface, clients always know exactly what they're paying for, and can see the options of how to pay. It is a tremendously powerful tool, and I cannot recommend it highly enough.

—David Lopez-Kurtz, BSL Group

No more manual process of adding revenue to your accounting software.

No more risky business of having your crypto sent to the wrong address.

No more waiting on your client to email you with confirmation or watching the block explorer for a payment to come through.

No more incorrectly recorded transactions into QuickBooks.

Final thoughts

Manually sending and processing crypto invoices is time-consuming, prone to costly human mistakes, and challenging to track with your accounting software.

You can solve this with Gilded’s crypto invoicing solution, so your invoices only take a few seconds to send, remain free from error, and easily sync up to your accounting system.

With Gilded, you don’t waste precious time and resources sending crypto invoices or risk losing out on hard-earned revenue. You’ll easily accept crypto payments, send invoices, and be confident in your entire accounting workflow. Easy win.