The last few months have been challenging for crypto operations teams — it seems like the bears have taken hold for now.

TerraUSD lost its peg to the U.S. dollar, as well as more than 99% of its value. Celsius Network became insolvent and paused withdrawals, ultimately filing for Chapter 11 bankruptcy. According to filings, it owes its user base — which includes institutional clients — a total of $4.7 billion.

Perhaps your operations team was affected by one of these events — that’s certainly not a fun place to be. Both incidents had a massive impact on the movement of the crypto market.

A bear market is defined by a substantial drop in the market across a short period of time.

Check.

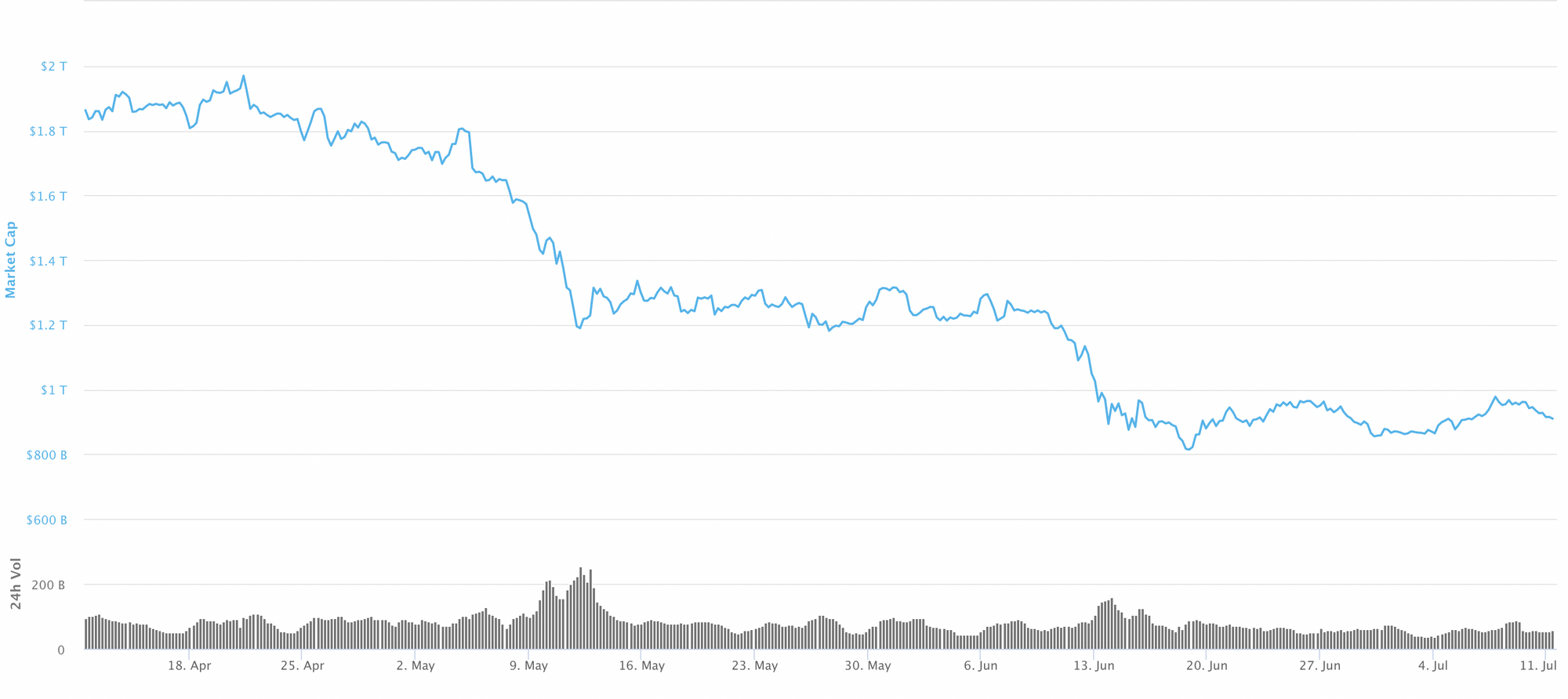

Between May 2022 and the time of this piece, the market’s total value has fallen by more than half.

We don’t recommend your team follow every movement in the market as a whole. That’s enough to make anyone pull their hair out.

You might be feeling frustrated — but, as the saying goes: bear markets are a time for building.

We've put together a list of 6 things your team can do to navigate the bear market (and emerge stronger on the other side).

1. Perform a proper inventory of your team’s crypto assets

In order to know which assets are exposed to current market weakness, it’s valuable to perform a proper inventory of the tokens you're holding and the protocols and services where your assets are being held.

Create visuals or statements, in order to develop forecasting techniques that relate directly to the needs of your operations team.

A financial report should be done on a consistent basis in bull or bear markets. This could be monthly, quarterly, or alongside your financial closing process — it all depends on your company’s specific needs.

The goal is to create an accurate picture of your company’s financial situation.

Your inventory of assets in crypto might include 10-20 different tokens. Before getting involved in web3, this probably wasn’t the case — however, the fabric of the growing ecosystem is built from a variety of projects.

As an operations team, you might decide which projects you’d like to remain exposed to. It’s possible you want to exchange certain assets for stablecoins. There are a number of different stablecoins — however, the two largest stablecoins (USDC and USDT) account for nearly 80% of the market's supply.

2. Assess whether any custodians or DeFi protocols you interact with are at-risk

There are a few strategies to assess risk with DeFi protocols, but it can be difficult to entirely predict which protocols are vulnerable. Even well-known trusted protocols can be compromised — like the BadgerDAO incident in late 2021. Evaluate your exposure carefully.

Similarly, it might be wise to become conscientious of the centralized services you interact with. These include exchanges, yield providers, and custodians for transitions between fiat and digital assets.

Use this time to research the projects you have exposure to. Learn how each of the projects work, if the code has been audited by a reputable third party, and the track record of the teams involved. Your business might be able to protect itself from situations that could lose a lot of money.

It's possible you'll need to visit the trenches to figure out if any DeFi protocols your operations team interacts with are at-risk. Perhaps you'll simply make a habit of considering which decentralized apps (dApps) you’re not interested in using. If you have funds in a protocol that falls short in any areas of your assessment, you should consider taking that money out.

Your team might also want to check the smart contracts you’ve given allowances to spend funds. A bug in a smart contract could leave your funds vulnerable to be lost by an external party.

3. Develop a plan for managing the volatility of your treasury

It’s never a bad idea to have a plan in the financial world — regardless of the different investment perspectives, most accountants consider it essential.

This might be a good time to update your operations team’s financial policies (especially related to crypto).

If you don’t have a treasury management policy in place, it’s the perfect time to establish one.

This policy is comparable to a minimum balance policy that you’d have with your bank account. It would also be similar to your investment policy, stating the types of holdings your company invests in.

The actual details for protecting your assets in crypto are up to you — however, there are a number of well-known strategies in the crypto space.

You can use stablecoins as a safety net.

Use them to hedge yourself against exchange risk — by transacting with stablecoins, you’ll be able to avoid the fluctuations of more volatile assets (and not just cryptocurrency).

Other plans include investing (or doubling down) in certain assets, or simply not doing anything at all. Tips 4 and 5 will give you a little more insight in terms of the directions you could go.

4. Create accurate financials that uncover opportunities for reducing expenses

Look at your finances through the lens of an accountant. Is your company subject to impairment loss rules? Do you recognize unrealized gains and losses on your financial statements? These topics should be discussed with your accountant to know if your statements are presented in the fairest way possible.

Do you have a current budget and a plan for 18-24 months of runway? Perhaps a mid-cycle budget review is needed, to ensure you’ve accounted for crypto expenses that should be reduced. Performing an actual vs. budget analysis is the key to determining this.

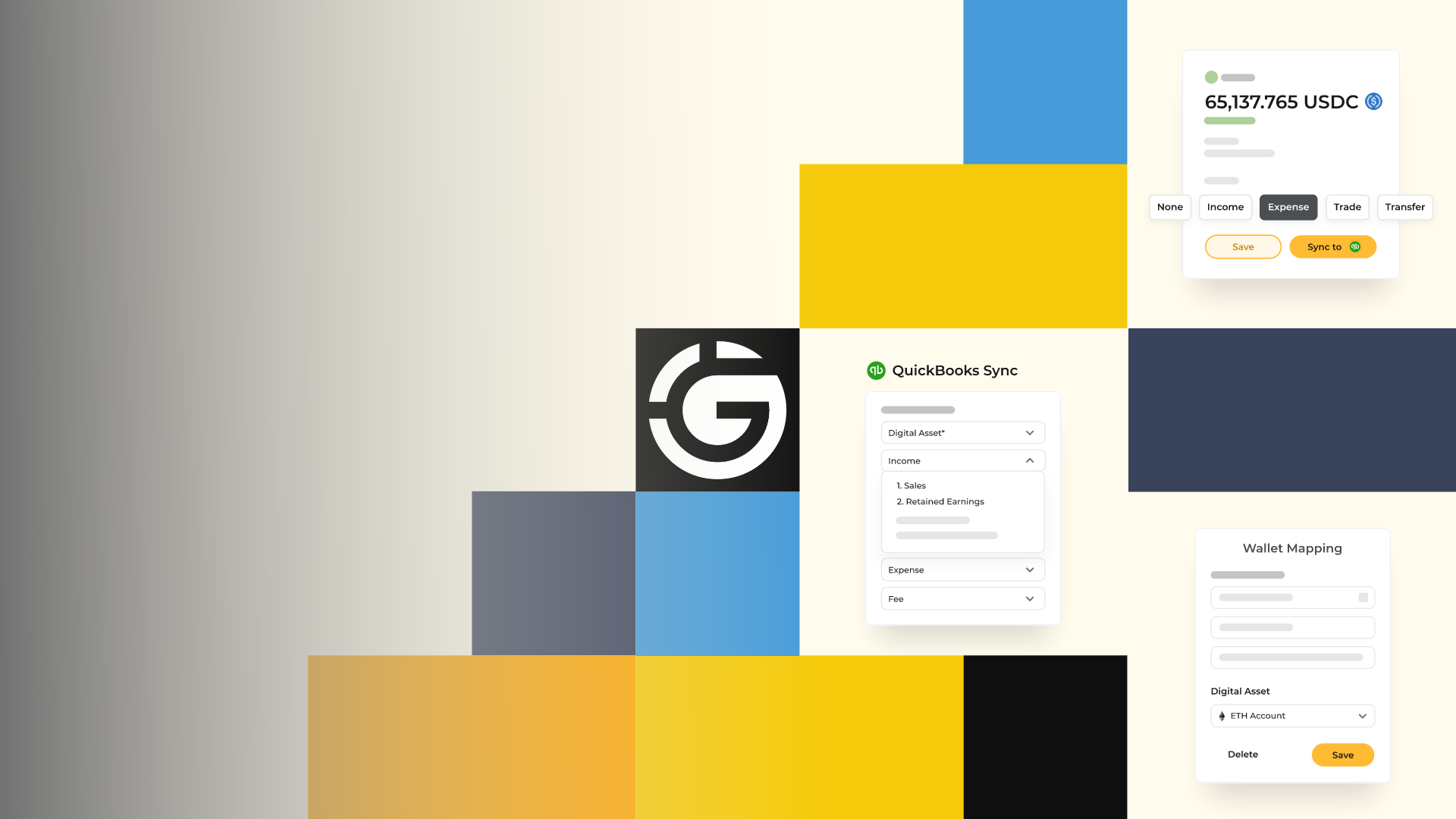

If you’re operating in both fiat and crypto, you can use Gilded’s QuickBooks sync as a way to produce consolidated financial statements.

Seeing your financials in a single database will provide a more coherent picture when looking for opportunities for reducing expenses.

5. Consider if now is the right time to double down

This could mean investing in crypto assets at low prices, laid-off talent flooding the market, or products that will set you apart from the competition.

Review your overall business plans to determine if this is the direction you want to go. If necessary, use this time to reset. Otherwise, keep building and buy the dip.

By investing in laid-off talent, you’ll be able to strategically bolster your team.

In July, the largest NFT marketplace, OpenSea laid-off 20% of its staff. A month earlier, Coinbase did the same.

Many of these employees are veterans of the web3 space. They’re likely searching for new companies to join. They want to share their experience on these larger platforms with operations teams interested in laid-off talent.

6. Solidify your operations tech stack

Finally, you might be interested in new products to expand your operations.

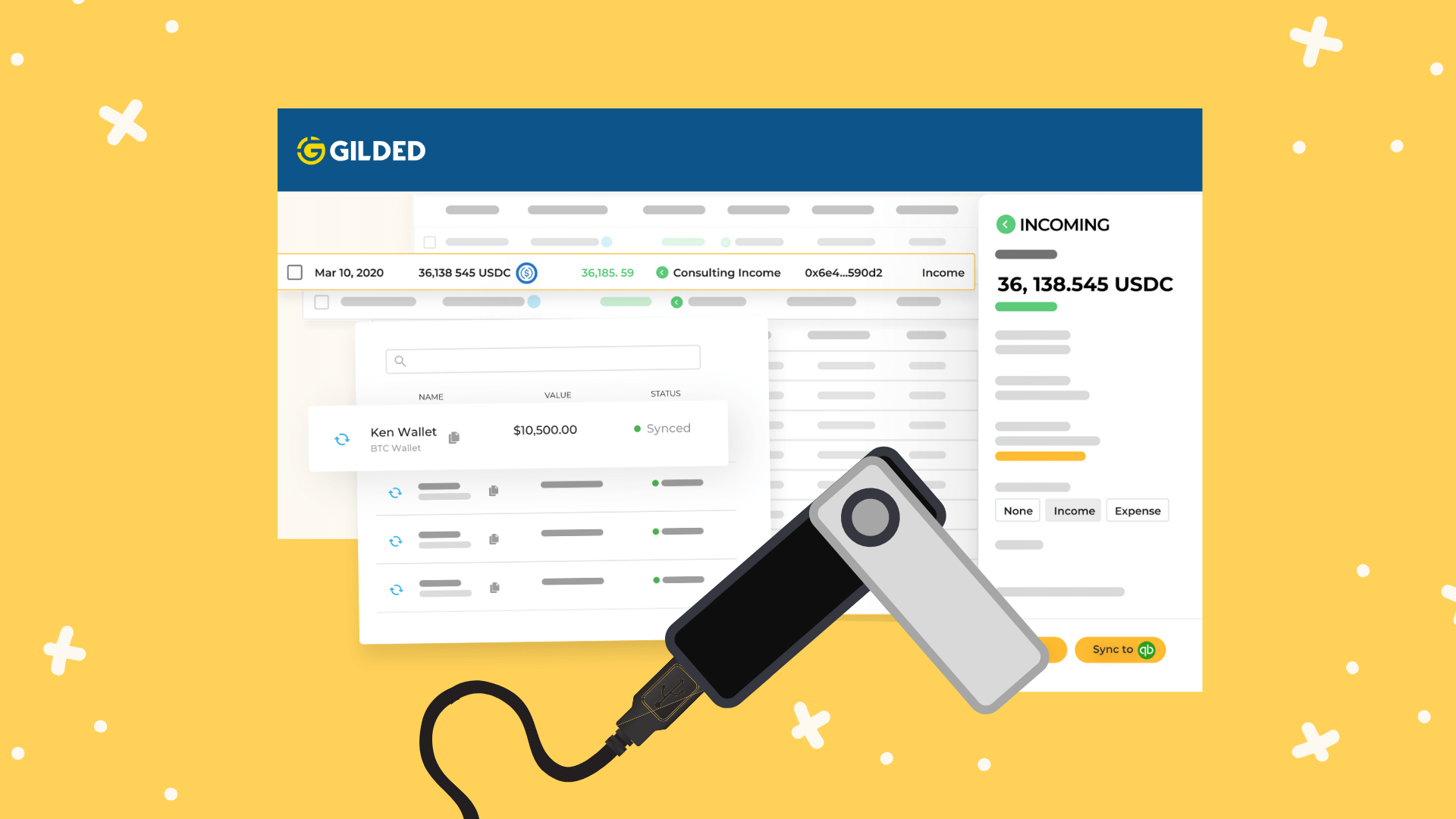

It's important to operate effectively and safely. This means keeping track of your inventory and making sense of it for reporting purposes.

That’s not easy to do with spreadsheets and Etherscan. We recommend Gilded's crypto accounting software for a complete unified view of your organization's finances.

If you’re looking for a way to manage bookkeeping for cryptocurrency, there isn’t a more powerful tool than Gilded's Compass, which allows to you customize your QuickBooks mappings and increasingly optimize reconciliation.

You don't need to understand how an internal combustion engine works in order to drive a car and the same is true of blockchain technology. Managing your digital assets effectively does not require advanced knowledge of the complexities of blockchain.

Gilded simplifies crypto operations for both crypto-native and new-to-crypto teams. With a seamless flow into QuickBooks Online (QBO), the process is intuitive and familiar to accounting pros.

We love making life easy for finance teams.

A final thought

Building for the future often means putting in extra work during a bear market. Markets are cyclical. We’re likely to experience another bull market in the next few years.

The way you prepare for the future is ultimately your organization's decision. There are a number of strategies your operations team can leverage to make the most of any market downturn.

Happy building!

Want to see how Gilded can optimize your crypto operations workflow? Request a demo today. 🪄

Related reading

Founded in 2018 by a team of developers and CPAs, Gilded believes that the future of finance is global, open, and powered by blockchain. Our mission is to onboard the next million businesses to web3 by providing the financial tools to succeed in this new reality. Backed by Techstars and the Association of International Certified Public Accountants (AICPA), Gilded powers operations for companies building in web3.

Connect with us on Twitter and LinkedIn.