We live in a world where fiat money still reigns supreme but the economic landscape is changing quickly. Bitcoin is a once-in-a-millenium innovation. Not only has it laid the ground work for cheaper and faster global payments, but has also enabled commerce without middlemen (i.e. banks), who have perpetuated so many inefficiencies in the traditional financial landscape.

As digital assets become increasingly mainstream, it's important to understand how to incorporate bitcoin and crypto into your billing and accounting process. But tracking your transactions and crypto journal entries can be a major hassle.

Let's take a look at how to properly account for your bitcoin transactions. The same rules apply for most other cryptocurrencies but for the sake of this article, we want to focus on your BTC transactions.

1. Bitcoin: the first cryptocurrency

On October 31, 2008, the anonymous Satoshi Nakomoto published the Bitcoin whitepaper: Bitcoin: A Peer-to-Peer Electronic Cash System — and with that, revolutionized our global economy.

Created during the U.S. Mortgage Crisis of 2008 and 2009, bitcoin is the most widely known and respected digital currency with hundreds of other projects created in the image of its transformative technology. Bitcoin is created, distributed, traded, and stored with the use of a decentralized ledger system known as a blockchain.

While some might argue that bitcoin wasn’t the first cryptocurrency, it’s undeniable that it was the first to become mainstream with its “proof-of-work” and decentralized approach.

2. It's stored in software-based digital wallets

Unlike bank accounts that hold your money in a custodial account, bitcoin is stored in a digital wallet, also known as a cryptocurrency wallet.

A crypto wallet is a software program which stores your private key (think of it like a password) in order to talk to the blockchain. The wallet allows you to do things like monitor your balance and send or receive coins.

Examples of crypto wallets: Coinbase, Ledger Nano S, and Exodus Desktop Wallet

To learn more about digital wallets, check out our article on The Best Crypto Wallets for Business.

3. You can hold on to the funds yourself or rely on a custodian to keep them safe

There are two different types of digital wallets: custodial and non-custodial.

The key difference between the two is that custodial wallets are third party services that hold on to your private keys and provide backup support for your crypto assets. This includes most exchanges and brokerage services (such as Coinbase) that allow you to buy, sell, and store digital currencies. You can think of a custodian as an organization that acts like a bank, holding your funds securely on your behalf.

On the other hand, non-custodial wallets are decentralized and 100% user-controlled, meaning that no individual or organization holds on to your private keys; only you do. You can think of a non-custodial wallet as similar to the wallet in your pocket or purse; your wallet directly holds onto your funds and you’re free to spend them as you’d like.

4. All Bitcoin transactions are public

Every bitcoin transaction is publicly viewable. That’s the whole idea of the blockchain in the first place, as a public ledger for anyone to verify a transaction. If you ever want to look up a bitcoin transaction you’ve made in the past, then you can easily locate it on a block explorer such as blockchain.com if you know the bitcoin address or transaction hash.

If you want to know more about tracing bitcoin transactions, here's a good article from the support team at Blockchain.com.

5. Bitcoin Wallets can have multiple addresses made up of UTXOs

Bitcoin and other cryptocurrencies use a different approach compared to traditional double-entry accounting.

Rather than having an account-based solution like banks with debits and credits, Bitcoin deploys a system called Unspent Transaction Outputs (UTXOs). UTXOs are simply the amount of digital currency you have left after making a transaction with Bitcoin. They are responsible for beginning and ending each transaction, similar to how debits and credits end each transaction for fiat.

In addition to knowing about UTXOs, you will also need to know about an Extended Public Key (or xPub), which can easily be thought of as a master view into a wallet’s activity.

Watch this video to learn more about UTXOs:

6. Every BTC transaction incurs a fee, which must be accounted for along with the value

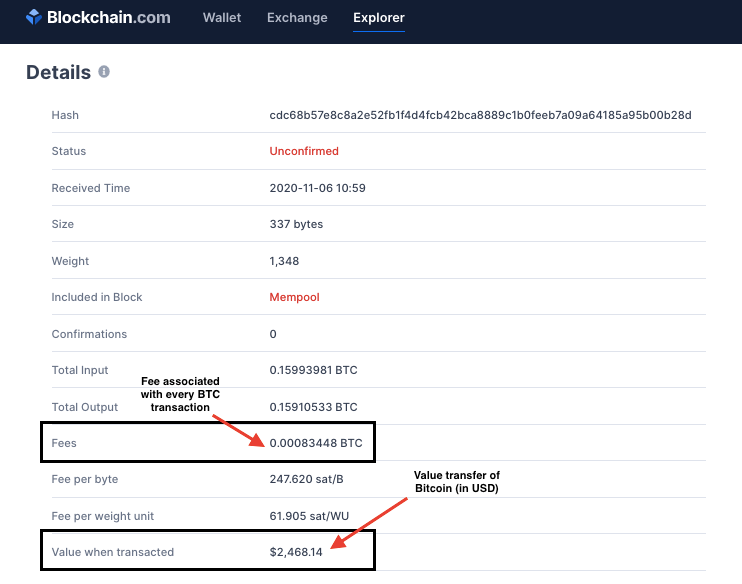

Each time you make a transaction, you need to account for the value transfer as well as the transaction fee. The transaction fee is the fee paid to the blockchain network in order to be able to make the transaction possible. Whenever you’re making a Bitcoin transaction, there will be a fee and this fee will depend on the volume in the network at the time.

Here is a screenshot of a public Bitcoin transaction from blockchain.com that shows how the fee applies to the transaction:

And if you want to understand bitcoin fees from a high level, check out this explanation from 99Bitcoins:

7. In most countries, you will need to report BTC transactions on your tax returns

While bitcoin was able to slide under the radar with taxes for a long time, this is far from the truth today. Crypto tax regulations vary from country to country. Remember to look into your country’s crypto tax laws so you can understand the landscape. If you live in the United States, the IRS revamped their 2020 tax forms to include reporting crypto transactions as one of the first line items.

In the United States, bitcoin is taxed as property. To determine tax liabilities, you must first know the cost basis for each incoming bitcoin transaction. Then, you can calculate the gain or loss on each outgoing transaction.

Read more: How to calculate your cost basis

8. You can account for bitcoin transactions using a spreadsheet

Most people have always tracked their bitcoin transactions using a spreadsheet. You can do that using an Excel or Google Sheets document.

Most people start by attempting to account for their bitcoin transactions using a spreadsheet. For a DIY approach, we recommend finding a pre-made spreadsheet like this open-source spreadsheet and then creating a copy yourself. Here is a preview of what that would look like for you:

If you click on the viewable Google Sheet from above, the first page on the sheet – “Introduction - START HERE” – presents a great overview of how to use the sheet.

After talking with hundreds of businesses and individuals using cryptocurrency, we’ve discovered that spreadsheets are causing issues in the long term when it comes to tracking your transactions. This is problematic because:

1. It’s prone to human error.

2. It’s easy lose track of the paper trail of your transactions.

3. It creates insecure data.

4. It has a lack of customizable features.

9. You can make your life easier with crypto accounting software

While spreadsheets are easy to manage when you have a small number of transactions, higher volumes can cause you to spend hours or even entire days every month reconciling.

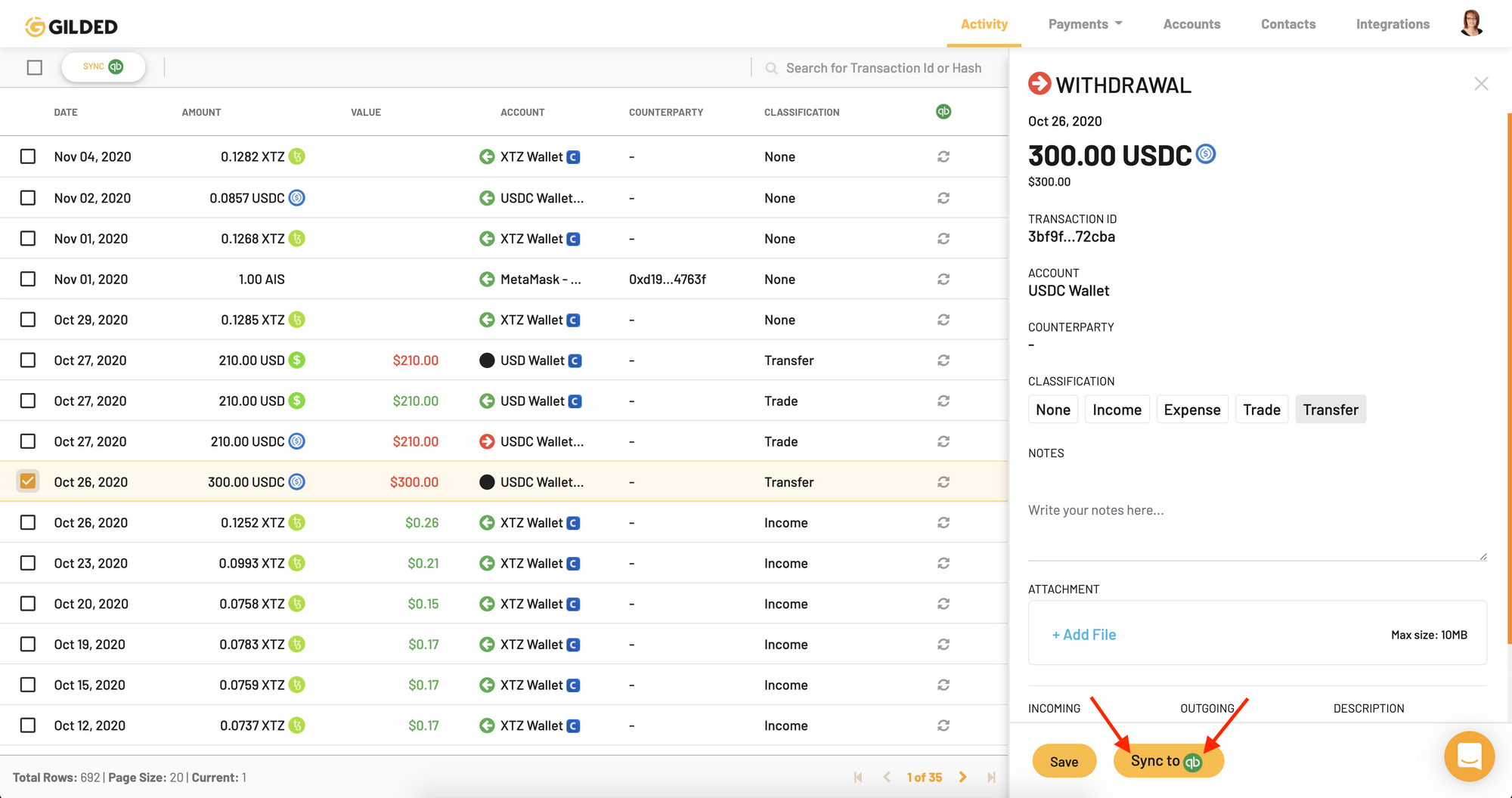

Fortunately, crypto accounting software like Gilded exists to automate many of the tedious, manual steps required to account for bitcoin transactions. With Gilded, you can aggregate transactions from multiple wallets, calculate spot prices and cost basis, categorize and tag transactions, and much more.

If you are a crypto accountant or someone looking to up their accounting game, then you should look into automating your crypto accounting. Schedule a demo with Gilded to get started. There’s no reason to still use spreadsheets if there’s an easier and faster solution out there.

10. Using QuickBooks or Xero for crypto accounting

Another option for accountants and finance teams is QuickBooks or Xero. These are perfectly adequate accounting softwares for the pre-crypto world. But they miss the mark on integrating crypto with their products. Crypto accounting software is needed in order to properly account for the intricacies of digital currencies.

That’s where Gilded comes in with our QuickBooks integration and soon-to-be-launched Xero integration. You can easily connect your QuickBooks account with Gilded so that you don’t have to worry about missing a transaction that could cost your business thousands of dollars.

What are your biggest obstacles with managing your BTC transactions?

Want to automate your bitcoin accounting? Request a demo with one of our crypto accounting experts today.