If you’re a business and your company is transacting with cryptocurrency, you'll have to report your cryptocurrency transactions to the IRS.

There are nuances to tax accounting for cryptocurrency that can be puzzling and somewhat intimidating.

However, if you follow some simple guidelines and document your transactions properly, you’ll have a clear and reliable path for properly accounting for cryptocurrency revenue, expenses, and taxable gains or losses.

In this post we will answer some of the questions that we field from our crypto accounting software customers concerning cryptocurrency taxes for businesses.

And you’ll learn the fundamentals of proper crypto tax accounting, so, together with your external accounting firm, you can file compliant tax returns.

And you won’t have to worry about surprises from regulatory authorities, or unexpected tax bills.

As a caveat, we aren’t your CPA’s and your tax advisors, so please review the facts and circumstances of any cryptocurrency transactions your business engaged in with a qualified cryptocurrency-familiar CPA.

Frequent Questions:

- How do I account for revenue and expenses?

- What does it mean that crypto is taxed as property?

- What’s considered a taxable event in crypto?

- How do I account for taxable gains and losses?

- How do I calculate the cost basis?

- What about DeFi, NFTs, and yield farming?

Revenues & Expenses with cryptocurrencies:

Accounting for revenue and expenses in cryptocurrency is the same as in fiat currency.

Any revenue for selling goods or services in cryptocurrency should be valued at the time the cryptocurrency is received at a documented exchange spot price.

If you are using an accrual method, the revenue should be recorded at a documented spot price at that time of the revenue recognition.

Any expenses incurred by paying for goods or services should be valued at the time the cryptocurrency is paid at a documented exchange spot price.

If you are using an accrual method, the expense should be recorded at a documented spot price at that time of the expense recognition.

It’s simple, but not necessarily easy, since you have to document the exchange rate.

More on that below.

However, as we all know, cryptocurrencies fluctuate as to their value in fiat currency.

Do you have to pay taxes on cryptocurrency gains?

Yes.

In the United States, for example, cryptocurrency is taxed as property and subject to a capital gains tax based on realized gains or losses.

A realized gain or loss is the gain or loss that occurs due to a transaction, like a trade, purchase, or sale.

What does it mean for crypto to be taxed as property?

If your business bought a cryptocurrency asset and sold it for a profit, your business will be liable for the capital gains on that asset—like real estate or stocks.

The amount of gain you are taxed on depends on:

- How much capital gains you realized

- How long you held the cryptocurrency asset

For each taxable event (realization of a gain or loss), you will need to keep track of the date, spot price, cost basis, and any associated fees.

Fees, if not already deducted in your operating expenses, can be deducted from the gain on the sale to get to the calculated net proceeds amount.

Likewise, if the business sold any cryptocurrencies for loss, you could also use those losses to offset against any other business capital gains.

This means that when your business realizes losses after trading, selling, or otherwise disposing of its cryptocurrencies, your business’ losses offset your capital gains for the same year.

It’s important to keep accurate, detailed records of your losses rolling forward so you can take advantage of the tax benefits of offsetting potential future gains.

Bitcoin was down ~ 60% in 2022.

If your business incurred Bitcoin losses, you could offset any of those unused realized losses against any future realized capital gains, or against previous, realized capital gains for which you did not have same year capital gains losses.

Per the IRS Instructions for Schedule D (Form 1120), “For a corporation, capital losses are allowed in the current tax year only to the extent of capital gains. A net capital loss is carried back 3 years and forward up to 5 years as a short-term capital loss.”

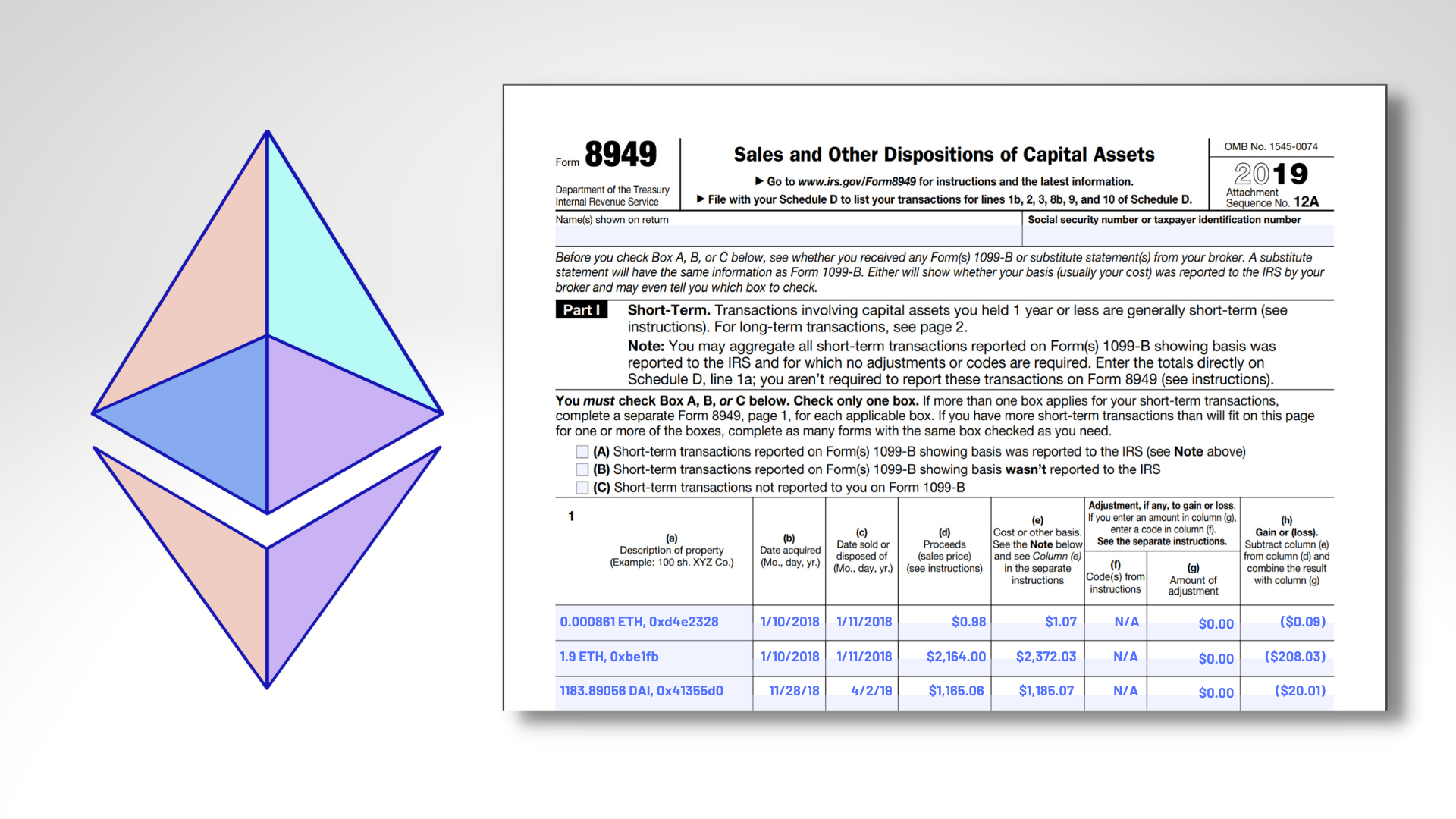

You report sales and exchanges of capital assets on IRS form 8949.

If you’re unsure of how to track your transactions, you can schedule a demo with an expert at Gilded to see how easy it is to import your wallets and transactions into one easy-to-understand dashboard.

What crypto actions are considered taxable events?

- Trading crypto for crypto (e.g. ETH for BTC).

- Selling crypto for fiat (e.g., ETH for USD or EUR).

- Paying for goods or services with cryptocurrency (however, paying with stablecoins like $USDC typically results in minimal tax consequences).

- Receiving payments for goods or services, which is treated as ordinary revenue at the spot price at the time of receipt.

- Receiving cryptocurrency because of a fork or from mining (e.g., mining BTC).

What crypto actions are NOT taxable events?

- Transferring crypto between your own crypto wallets (e.g., sending ETH from your Coinbase wallet to your MetaMask wallet).

- Buying crypto with fiat (nontaxable until you pay for a good or service, sell, or trade the cryptocurrency).

- Gifting cryptocurrency (but if the gift is over $15,000 per year, then the recipient may be subject to a gift tax).

How do I calculate my cryptocurrency capital gain taxes?

The capital gains tax is based on two things:

1. Cost basis

2. Fair market value of your trade.

To calculate your taxable gain or loss, you’ll subtract the cost basis from the fair market value to find your capital gains.

Loss on Sale Example:

Let’s say you bought one Ethereum on April 3, 2022, for $3,500 and you sold that one Ethereum for $1,195 on December 31, 2022. Your business’ capital loss would be $2,305.

If your business had realized gains on other assets in 2022, you could offset (i.e., reduce) the tax on gains equal to the loss on the Ethereum sale.

Gain on Sale Example:

Let’s say you bought one Ethereum on June 17, 2022, for $1,086, and you sold it for $1,936 on

August 14th, 2022.

In this example, your gain on your cryptocurrency is $850.

You will be taxed on the gain, which can be offset against any capital losses in the same year, any losses you rolled forward from the previous year, or any future gains over the next five years.

It’s important to report all your trades, regardless of whether it was a loss or gain, so that you can roll forward net losses for future years.

FIFO vs. LIFO cost basis

To calculate your cryptocurrency capital gain/loss tax burden, you will simply need to match the cost basis to the fair market value from the sale.

However, it gets tricky when you have multiple cost bases for the same type of asset.

Let’s say you bought one bitcoin at $10,000 on June 8, 2019, and another bitcoin at $9,500 on July 26, 2019.

Assume you then sold one bitcoin for $16,520 on December 31, 2022.

Which cost basis would you use?

If you used FIFO (or First In, First Out), then you would use the first purchase ($10,000) for the cost basis and your capital gains would be $6,520.

On the other hand, if you used LIFO (or Last In, First Out), then the cost basis would be based on the last purchase ($9,500), and your capital gain would be $7,020.

You may choose LIFO if you can specifically identify which unit, or units, of cryptocurrency are involved in the transaction and substantiate your basis in those units.

However, Per IRS FAQs--A41, if you do not identify specific units of cryptocurrency, the cryptocurrency units are deemed to have been sold, exchanged, or otherwise disposed of in chronological order beginning with the earliest unit of the cryptocurrency you purchased or acquired; that is, on a First In, First Out (FIFO) basis.

So you can’t use LIFO unless you can identify the specific units being sold on each transaction.

Given the nature of business transactions and the use of fractional coins, LIFO is almost impossible for a business, at volume, to use as a method for basis valuations.

Given the complexities and record keeping involved, we steer our software customers towards FIFO.

Long Term vs. Short Term Capital Gains

Usually, the longer you hold a capital asset, the lower your tax rate will be on any gains on the sale of that asset.

If your business sold its Bitcoin less than 12 months after it bought it, then the business is subject to short term capital gains tax rates.

Conversely, if you sell after the 12-month period, then you will have the benefit of lower, long term capital gains tax rates.

As a reminder, we recommend talking to a crypto tax professional for help in calculating gains and losses.

How do I account for crypto taxes like DeFi and NFTs?

Decentralized finance (DeFi) and non-fungible tokens (NFTs) have experienced significant growth and can seem complex.

However, accounting for these types of trades are simpler than they might seem.

At the most basic level, anything that generates income for the business, net of expenses, will result in taxable income (the same is true for your DeFi and NFT income).

To learn more about accounting treatment for NFTs, check out our more detailed NFT accounting guide.

What tools will help me?

At Gilded, you can use our software to consolidate your business’ wallets and give accurate spot price data for every transaction, including historical prices.

Pegging exact prices for cryptocurrency assets is more than half the battle in properly documenting your tax reports.

Trust Your CPA

Finally, get an experienced CPA who works with cryptocurrencies and can help you navigate your tax accounting for cryptocurrency.