Updated to reflect current data: June 15, 2022

NFTs have exploded in the past two years, empowering a new generation of artists and entrepreneurs to directly monetize their audience and claim a larger piece of the pie.

Beeple, one of the most famous digital artists in the NFT space, recently sold his NFT digital artwork for $69 million through Christie’s auction house. That makes it the third-most expensive art sale by a living artist ever.

Why are NFTs important? Digitally native goods and collectibles aren’t new, but the way the smart contract creates provable ownership is a huge boon to artists and creators. Countless artists, musicians, and creators have been burned by bad contracts in the past. NFTs provide creators with a streamlined gateway for equitable digital ownership and the ability to sell their work peer-to-peer. It’s another way that blockchain cuts out the “middlemen” and the greater impact of this technology is promising beyond art and collectibles.

NFTs and the associated high ticket sales became one of the hottest tech sensations of 2021, virtually overnight. While the initial hype might die down, this novel use of blockchain is here to stay.

NFT accounting might not be the most exciting aspect of the emerging art form, but it’s important to have your books right—or risk a tax or legal nightmare. Whether you represent a marketplace, or you’re an artist, musician, or creator—it’s imperative to learn how to bookkeep and perform accounting for NFTs accurately.

But first, what in the world is an NFT?

What is an NFT?

NFTs, or non-fungible tokens, are digital assets with blockchain-centric ownership.

The reason they are non-fungible, as opposed to fungible, is because you cannot trade or exchange one NFT for another. On the other hand, with bitcoin or other cryptocurrencies, they are identical to each other (1 bitcoin=1 bitcoin, 1 ETH=1 ETH) and, therefore, can be used transactionally.

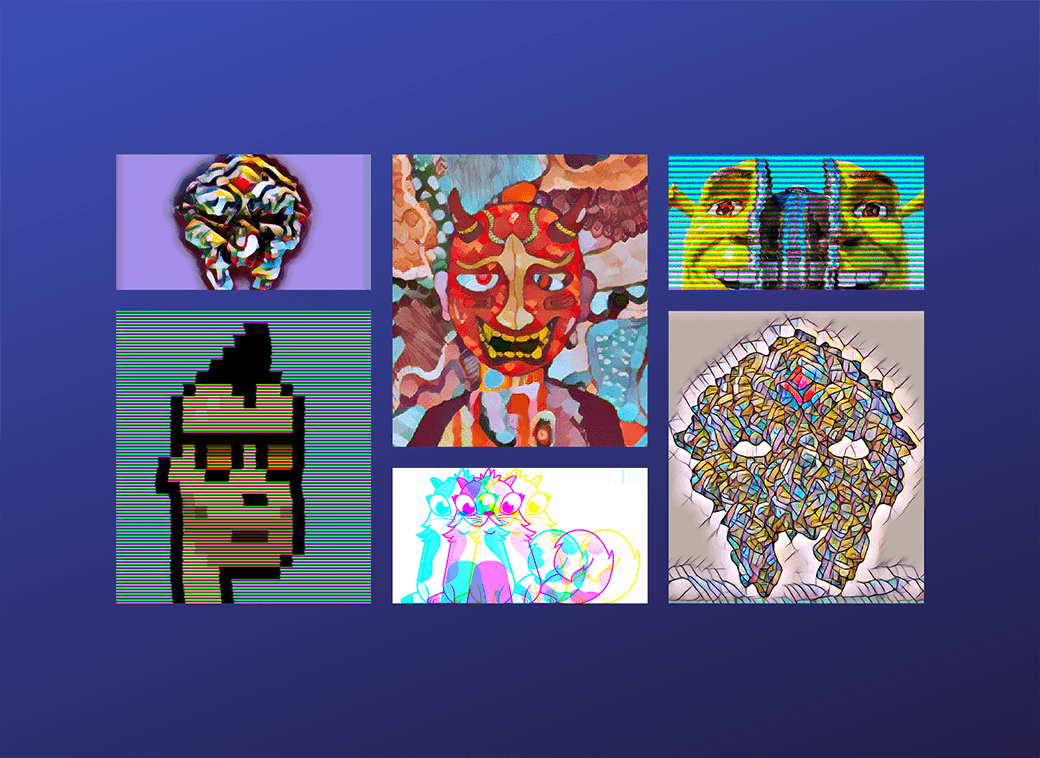

Some examples of NFTs include collectibles, digital art, game items, music, event tickets, domain names, and ownership records for physical assets. We’re in the midst of an NFT craze with frothy valuations on NFT issuances. The buzz likely won’t last forever, but we expect the long term use cases to evolve and endure.

For a further dive down the NFT rabbit hole, check out this comprehensive video on the new technology from The Defiant.

5 Things to Know about NFT Accounting

1. How are NFTs different from other cryptoassets?

The primary difference between NFTs and other cryptoassets can be boiled down to two facts. First, NFTs are unique and distinct assets, so this means that they cannot be exchanged for one another like bitcoin and other cryptocurrencies. Second, and since these crypto assets represent distinct claims linked to assets, NFTs cannot be divided and used fractionally as a currency equivalent.

2. What is the accounting treatment for NFTs?

Since there is no crypto-specific authoritative accounting guidance in the marketplace, the general rule is that cryptoassets are treated as the equivalent to indefinite lived intangible assets—a category that includes trademarks, and perpetual franchises. This is the same accounting treatment given to “goodwill,” an accounting asset that results from one organization paying a premium (over-paying) for another organization. However, with NFTs, depending on the underlying asset in question, as well as the process by which these NFTs are issued, the accounting treatment will change. This becomes the key differentiator of NFTs vs traditional cryptoassets. The underlying substance of what the NFT may represent could affect your accounting treatment.

3. What are the tax implications of NFTs?

Generally speaking, accounting for NFTs is similar to other cryptocurrencies. They're simply taxed and treated as property. Where the differentiation comes into play is whether or not a taxpayer is an NFT creator, or is simply buying and selling NFTs. Creators are taxed at the point in time that the NFT is sold, with any income being recognized as ordinary income. Buyers and sellers of NFTs are taxed similarly to how other cryptocurrencies are taxed, with long term capital gains rates, or short term (ordinary income) rates coming into play.

4. How do you value NFTs?

Although there are not wide and public markets to buy, sell, and trade NFTs, it's still important to establish some sort of valuation for these assets. Incidents like the frenzied buying around the Beeple artwork put aside—how exactly are these tokens to be valued? Again this links back to attempting to value NFTs as they are connected to the underlying asset in question. Regardless of whether or not the underlying asset is tangible or not, these tokens have some sort of stake or claim to these assets, and this proportional ownership must be reflected in the value of the token. For self-created tokens, this also exposes why current crypto accounting treatment as intangible assets is nonsensical—how can there be an asset on the books of an organization that have no assigned valuation? The cost to mint self-created tokens is minuscule, but there is obviously a market and large value placed on these assets.

5. What are the legal implications of NFTs?

While this may not seem like an accounting-specific question, in order to accurately value and account for any asset, crypto-based or not, the legal rights and associated implications need to be established. Although tracing ownership might be straightforward for digital assets stored on an underlying blockchain, this process becomes more complicated when physical assets are involved. For example, if there are NFT issuances connected to commercial real estate, with ownership also being subdivided, would these NFT holders be considered owners or simply investors/holders of some assets at fair market value? If you're asking the question, "why are NFTs important," the fact of recorded ownership is likely the best answer. However, the blockchain doesn't solve every issue — especially in situations where the lines between creators and investors are less clear. Fortunately, there is a lot of energy being directed to the field of NFT accounting. In the coming years, we'll see a lot more clarity in this space.

Does your NFT platform or marketplace have a revenue operations solution?

This article was written in collaboration with Joey Ryan, CPA, Dr. Sean Stein Smith, CPA, and Jonah Baer.

The article above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice.