Accounting for cryptocurrency in QuickBooks manually can be frustrating, time-intensive, and expose you to human error.

But you can solve those problems with crypto accounting software, and quickly and seamlessly integrate crypto transactions to QuickBooks.

Your transactions, asset values, and journal entries will be accurately synced to your general ledger accounts in QuickBooks.

And you won't lose your mind connecting transactions to QuickBooks, spending hours formatting spreadsheets and retrieving asset values, or (worst of all) creating incorrect financial reports.

In this blog, we’ll show how you can account for crypto in QuickBooks with confidence.

Request a demo to learn more about how to integrate crypto transactions with QuickBooks.

Can you track crypto directly in QuickBooks?

What is the current functionality like to track crypto in QuickBooks? QuickBooks doesn't natively support tracking crypto transactions.

As a stopgap, you can add certain coins as a currency, create a Chart of Accounts for crypto transactions, and add invoices or bills manually (more on this below).

The two biggest issues with tracking crypto directly in QuickBooks:

- QuickBooks only supports two decimal places. For cryptocurrency accounting, this is an issue because coins like Ethereum can have up to 18 decimal places.

- QuickBooks does not allow you to link your crypto wallets. If you have a high volume of transactions to track, it can become extremely burdensome to manually upload each transaction to QuickBooks.

In spite of those challenges, you can still add crypto transactions to QuickBooks manually.

How to account for crypto directly in QuickBooks Online

Accounting for crypto in QuickBooks all starts with your Chart of Accounts.

If you are accepting crypto or sending crypto, you’ll want to have an asset account for your crypto holdings that’s separate from your bank account or asset accounts.

To manage the flow of funds, you need to have a separate account set up for each wallet in the Chart of Accounts in QuickBooks. Later on, you will be able to categorize your crypto transactions as income, expense, trade, and so on in QuickBooks.

First, add the cryptocurrency in QuickBooks (ex: adding Ethereum as a currency): Settings > Currency > Add Currency and set the exchange rate for each cryptocurrency to the USD equivalent.

Note: every time you add a new transaction to your chart of accounts, you will need to update the exchange rate.

- In QuickBooks, navigate to Accounting on the left sidebar > Chart of Accounts.

- Click New to set up a new account.

- Click Asset and save the account and tax form section as Other Current Assets. Choose the correct cryptocurrency (like ETH) as your currency.

Note: If you want to add expenses and revenue to this Account, you will want to save the cryptocurrency as a Bank asset instead. - Choose Other Current Assets as the account type and name it. Click Save and Close to create the account.

- Depending on your use of QuickBooks for crypto transactions, you will add new invoices or receive payments in crypto within QuickBooks.

- Rinse and repeat this process for each transaction.

Based on these entries, this will change what you see in your Balance Sheet (located in Reports) or your P&L statement.

Following this manual method of accounting for crypto assets involves multiple steps with moving parts that are slow, tedious, and subject to interpretation and variation.

There’s a quicker and simpler way.

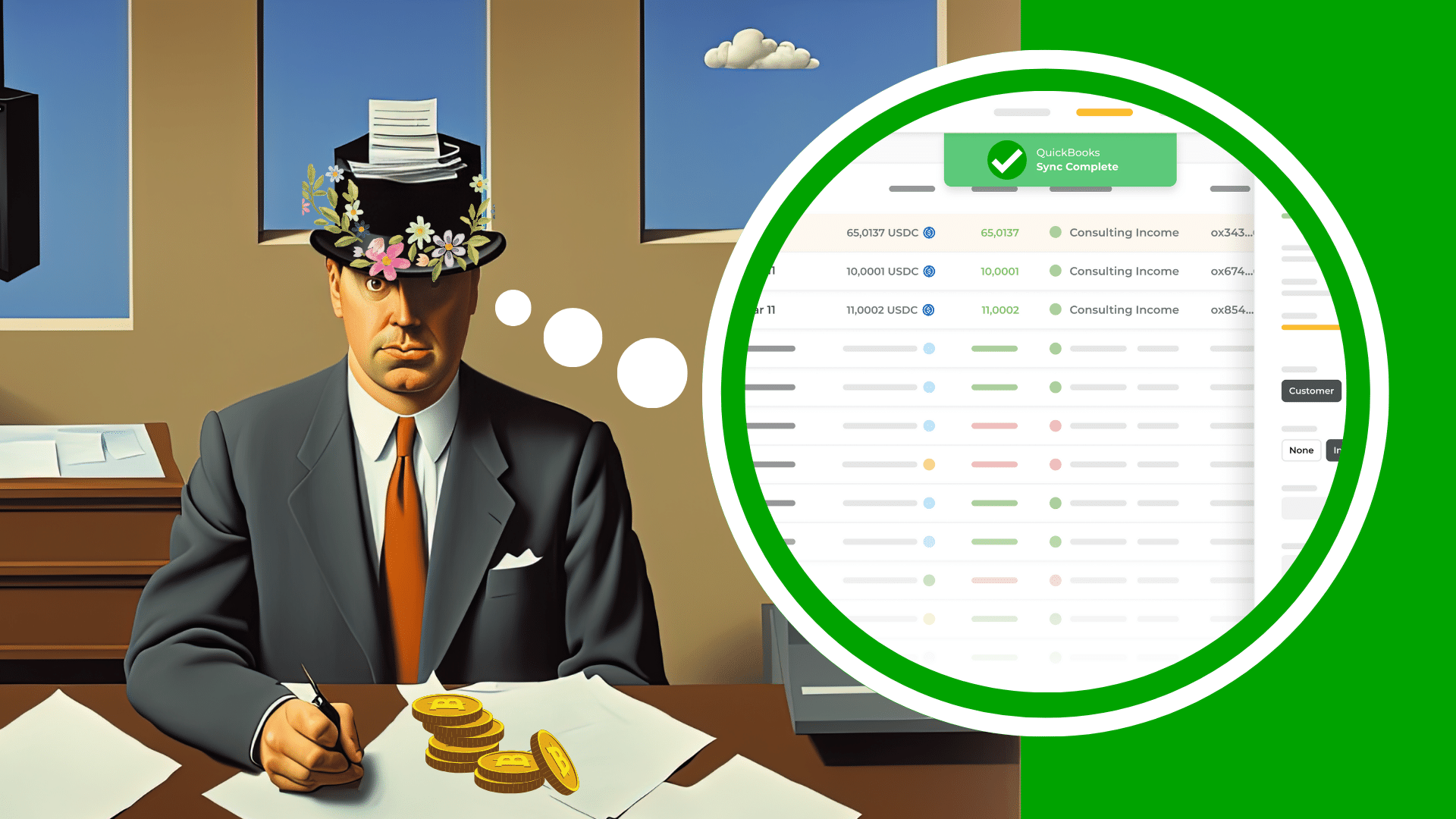

Simplifying crypto accounting with Gilded

Gilded is the #1 crypto accounting software solution integrated with QuickBooks.

With an advanced QuickBooks sync for crypto, accounting for cryptocurrency is fast, easy, and accurate.

Here's how it works:

- Add a crypto wallet or exchange account to Gilded. You will be able to see a full picture of your wallets and transactions in one place, and each transaction will have an accurate spot price.

- Create an asset account in QuickBooks for each wallet. This will make it easier to sync to QuickBooks in the next step.

- In Gilded, map the wallet to its corresponding asset account in QuickBooks. Sync transactions from Gilded by selecting crypto transactions to sync, and selecting the appropriate classification. You can enrich with notes and files, and map to the appropriate Chart of Accounts in QuickBooks.

After you are set up, you simply repeat steps two and three for new transactions.

Gilded streamlines the crypto tracking process, freeing you from manual entries that can get tricky, saving you time from slow uploads, and significantly reducing the risk of mistakes.

No more worrying about whether you correctly entered spot price data into QuickBooks.

No more countless hours of transaction reconciliation.

No more accounting nightmares.

With Gilded, you can sleep well knowing that you can integrate QuickBooks with Gilded’s crypto accounting software, speed up your process, and remove accounting risks in one easy workflow.

Final thoughts

It's important for accountants to accurately track cryptocurrency transactions.

Properly tracking these transactions in QuickBooks helps to ensure compliance and accuracy.

Of course, you can attempt to record these transactions manually.

But it’s a cumbersome process, wastes your valuable time, and you risk making mistakes in your financial reports.

By choosing a crypto accounting software like Gilded, you can automate this process, save time and money, and eliminate costly errors from your workflow.

We can help you get a clearer picture of the financial impact of your crypto assets and make better choices to grow your business in each financial period.

And you won't have to worry about any accounting mistakes later on.